1099 Form 2012

What is 1099 form 2012?

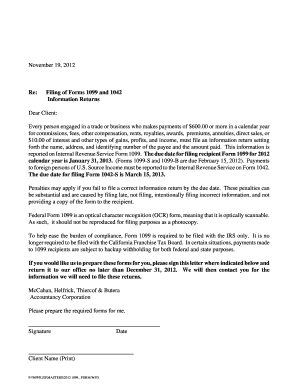

The 1099 form 2012 is a tax document used by businesses to report income other than their salaries, wages, and tips. It is specifically designed for independent contractors, freelancers, and self-employed individuals. This form is essential for accurately reporting and filing taxes.

What are the types of 1099 form 2012?

There are several types of 1099 forms for different types of income. Some common types of 1099 forms for the year 2012 include: - 1099-MISC: Used to report miscellaneous income, such as payments made to independent contractors and freelancers. - 1099-INT: Used to report interest income earned from investments. - 1099-DIV: Used to report dividend income. - 1099-R: Used to report distributions from pensions, annuities, retirement plans, or IRAs. These are just a few examples, and it is important to understand which specific type of 1099 form you need to use based on your income sources.

How to complete 1099 form 2012

Completing the 1099 form 2012 requires careful attention to detail. Here are the steps to complete the form: 1. Gather all necessary information: Collect the recipient's name, address, and taxpayer identification number (TIN). 2. Fill out the payer information: Enter your name, address, and TIN in the appropriate fields. 3. Provide income information: Report the amounts paid to the recipient in the designated boxes, organized by income type. 4. Submit copies: Send Copy A of the completed 1099 form to the IRS, Copy B to the recipient, and keep Copy C for your records. Make sure to review the form for accuracy and double-check all the information before submitting it.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.