Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

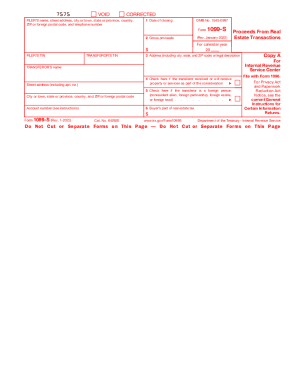

A 1099s form is a tax form used to report proceeds from real estate transactions. It is used by individuals, including real estate agents and settlement agents, who receive payment as a result of a real estate transaction. The form reports the gross proceeds from the sale or exchange of real estate and is typically issued to the individual who received the payment. The recipient must then report this income on their personal tax return.

Who is required to file 1099s form?

According to the Internal Revenue Service (IRS) in the United States, there are specific entities that are required to file Form 1099. These include:

1. Businesses: Individuals or businesses must file Form 1099 if they have paid a person or vendor $600 or more in the course of their trade or business. This includes payments made to independent contractors, freelancers, and self-employed individuals.

2. Rental Property Owners: Landlords or property owners must file Form 1099 if they paid $600 or more to a contractor, such as a plumber or electrician, for services related to their rental property.

3. Financial Institutions: Banks, credit unions, and other financial institutions must file various 1099 forms to report different types of financial transactions, such as interest income (Form 1099-INT), dividend income (Form 1099-DIV), and mortgage interest (Form 1099-MISC).

4. Healthcare Providers: Medical practitioners, hospitals, and other healthcare providers are required to file Form 1099 to report payments made to physicians, non-employee service providers, and other healthcare professionals.

5. Government Agencies: Federal, state, and local government agencies are required to file Form 1099 to report payments made to vendors, contractors, or recipients of grants, awards, or prizes.

It is important to note that the requirements and guidelines for filing Form 1099 can vary, so it is advisable to consult the IRS website or a tax professional for accurate and up-to-date information.

How to fill out 1099s form?

Here are the general steps to help you fill out a 1099 form:

1. Gather necessary information: Collect the relevant information about the recipient of the 1099, including their legal name, address, and taxpayer identification number (TIN), which can be their social security number (SSN) or employer identification number (EIN).

2. Obtain the correct form: Ensure you have the appropriate 1099 form based on the type of payment you are reporting. The common types include 1099-MISC, 1099-INT, 1099-DIV, 1099-R, etc.

3. Enter your information: Fill in your own information, including your name, address, and TIN, in the appropriate boxes.

4. Complete recipient's information: Enter the recipient's legal name, address, and TIN in the corresponding boxes. Verify that the TIN is correct by cross-checking it with the provided Form W-9.

5. Report income: Enter the total amount of income paid to the recipient in the appropriate box on the 1099 form. For example, if you are filing a 1099-MISC, enter the payment amount subject to reporting in Box 7.

6. Add state and local tax information: If applicable, enter any state or local income tax withheld or any other state-specific information in the designated boxes.

7. Duplicate and submit: If you are filing multiple 1099 forms for different recipients, make copies for your own records. Send Copy A to the IRS, either electronically or via mail, and provide Copy B to the recipient.

8. File the 1096 form: Additionally, if you are filing on paper, you will need to submit a 1096 form summarizing all the 1099 forms you filed. Include information such as the total number of forms, total amount reported, and your own information.

Remember, it is recommended to consult with a tax professional or use a reputable tax software to ensure compliance with the latest IRS requirements.

What is the purpose of 1099s form?

The purpose of the 1099s form is to report various types of income other than salaries, wages, and tips. It is used to report income earned by independent contractors, freelancers, self-employed individuals, and other non-salaried workers. The payer of the income is required to issue a 1099s form to the recipient and also send a copy to the IRS, ensuring that the income is properly reported and taxed.

What information must be reported on 1099s form?

The information that must be reported on a 1099 form includes the following:

1. Payer and recipient information: Both the payer's and the recipient's names, addresses, and taxpayer identification numbers (TINs) must be provided.

2. Type of payment: The specific type of payment made to the recipient must be reported. This could include various types of income such as interest, dividends, rents, royalties, nonemployee compensation, or other income.

3. Payment amount: The total amount of payment made to the recipient during the tax year must be reported.

4. Backup withholding: If backup withholding was applied to the payment, the amount withheld must be reported.

5. Accounts or investments: If the payment is related to an account or investment, such as an Individual Retirement Account (IRA) or a brokerage account, specific account or investment-related information may be required.

It is important to note that the specific reporting requirements may vary depending on the type of 1099 form being used (e.g., 1099-MISC, 1099-INT, 1099-DIV, etc.). It is recommended to consult the official IRS instructions for the specific form being filed to ensure accurate reporting.

When is the deadline to file 1099s form in 2023?

The deadline to file 1099 forms in 2023 is January 31, 2024. This date applies to both paper filing and electronic filing with the Internal Revenue Service (IRS). It is important to note that this deadline applies to 1099 forms reporting non-employee compensation (Box 7) only. Other types of 1099 forms may have different filing deadlines.

What is the penalty for the late filing of 1099s form?

The penalty for the late filing of 1099 forms depends on how late the forms are filed and the size of the business. If you file the 1099 forms within 30 days of the due date, the penalty per form ranges from $50 to $270, depending on the size of the business. If filed more than 30 days after the due date but before August 1st, the penalty per form ranges from $110 to $540. If filed after August 1st or not filed at all, the penalty per form ranges from $270 to $1,090. The penalties can vary depending on whether the late filing was intentional or not. It is advisable to consult the IRS guidelines or a tax professional for specific penalty amounts as they can change over time.

How can I send 1099s 2012 form for eSignature?

When you're ready to share your 1099s 2012 form, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for signing my 1099s 2012 form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your 1099s 2012 form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit 1099s 2012 form on an Android device?

You can edit, sign, and distribute 1099s 2012 form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.