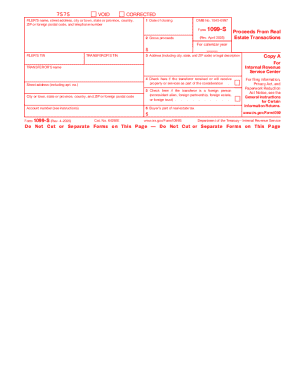

IRS 1099-S 2017 free printable template

Instructions and Help about IRS 1099-S

How to edit IRS 1099-S

How to fill out IRS 1099-S

About IRS 1099-S 2017 previous version

What is IRS 1099-S?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-S

What should I do if I realize I've made a mistake on my IRS 1099-S after submission?

If you discover an error on your IRS 1099-S after filing, you must submit a corrected form. Identify the mistake, cross-check details, and then file the corrected form clearly marking it as 'Corrected'. Keep copies of both the original and corrected forms for your records.

How can I verify that my IRS 1099-S has been received and accepted by the IRS?

To track the status of your IRS 1099-S, you can contact the IRS directly or, if e-filed, check your e-filing software for confirmation of submission. Look for any rejection codes; if your submission was rejected, the software typically provides guidance on necessary corrections.

What are common errors filers make when submitting the IRS 1099-S?

Common errors on the IRS 1099-S include incorrect taxpayer identification numbers, mismatches in property descriptions, and failure to report necessary amounts. To avoid these mistakes, double-check all information against official records and ensure all required fields are completed accurately.

Can I file an IRS 1099-S on behalf of someone else, such as a family member?

Yes, you can file an IRS 1099-S on behalf of someone else if you have their consent. However, ensure you have the necessary power of attorney documentation and that you accurately report their information to avoid any compliance issues.

What should I know about e-signatures when submitting the IRS 1099-S?

When using e-signatures for the IRS 1099-S, confirm that your software supports electronic signatures and adheres to IRS requirements. Retain records of the signed documents, as the IRS does have specific guidelines on what constitutes acceptable e-signature legalities.

See what our users say