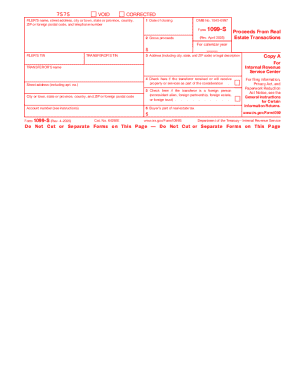

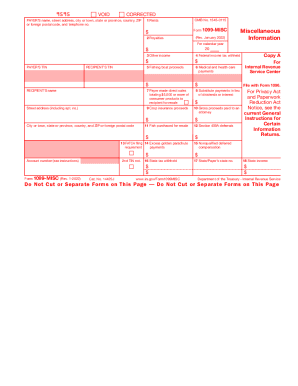

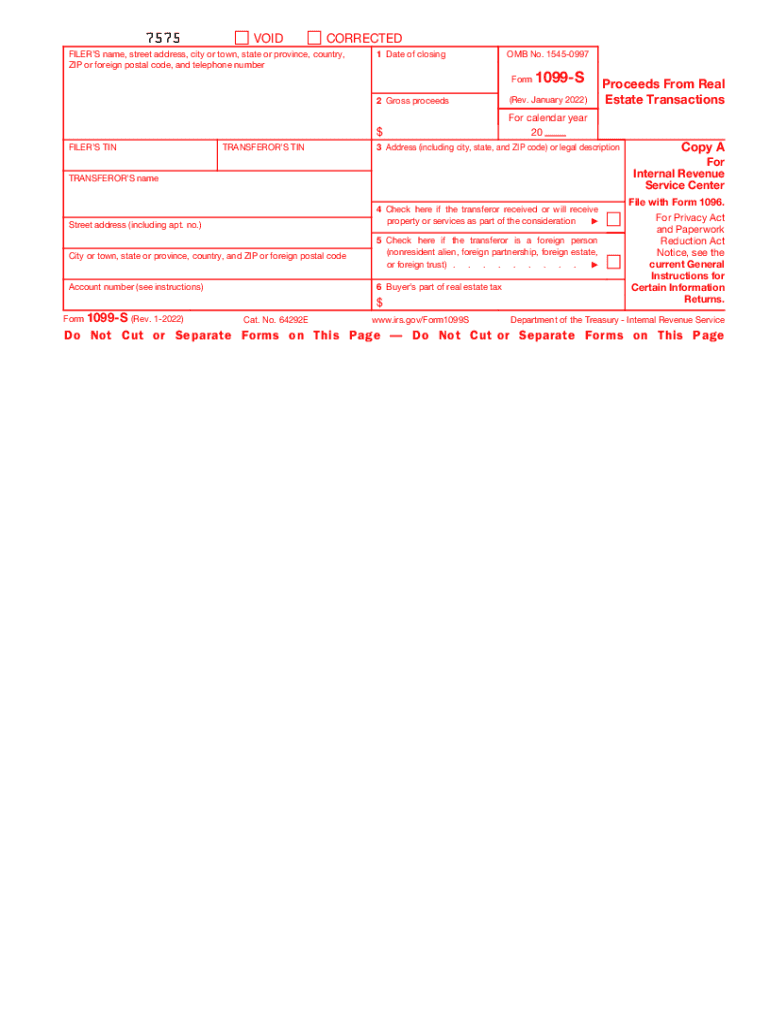

IRS 1099-S 2022 free printable template

Instructions and Help about 1099s

How to edit 1099s

How to fill out 1099s

Latest updates to 1099s

All You Need to Know About 1099s

What is 1099s?

Who needs the form?

Components of the form

What information do you need when you file the form?

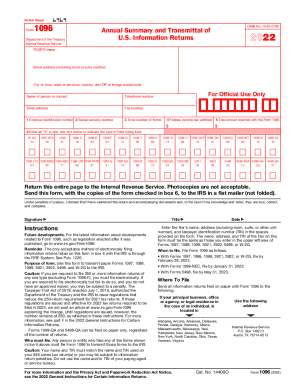

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1099-S

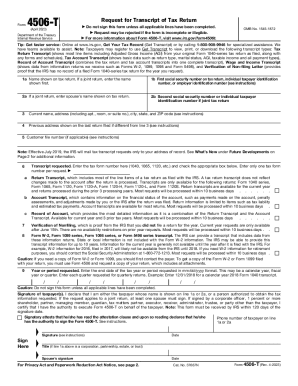

What should I do if I realize I've made a mistake on my filed 1099s?

If you've filed a 1099s with errors, you'll need to submit a corrected version. This involves completing the Form 1099-X specifically for corrections and ensuring any entities involved are notified. Timely correction is essential to avoid penalties associated with inaccurate reporting.

How can I track the status of my filed 1099s?

To track your filed 1099s, you can contact the IRS or utilize electronic filing services that provide status updates. Keep an eye out for common e-file rejection codes during the filing process, as these can indicate submission issues that need to be addressed promptly.

What legal considerations should I keep in mind when e-filing 1099s?

When e-filing 1099s, be aware of data privacy and security requirements, particularly when managing sensitive payee information. Additionally, consider whether e-signatures are accepted for the affirmation of your 1099s, as this may vary depending on your jurisdiction or the IRS's evolving guidelines.

Are there any special considerations for filing 1099s for nonresident payees?

Filing 1099s for nonresident payees requires attention to specific guidelines set by the IRS, including understanding withholding tax obligations. It may be necessary to file additional forms, such as Form W-8BEN, to ensure compliance with international tax treaties and regulations.

See what our users say