Child Benefit Online Account

What is child benefit online account?

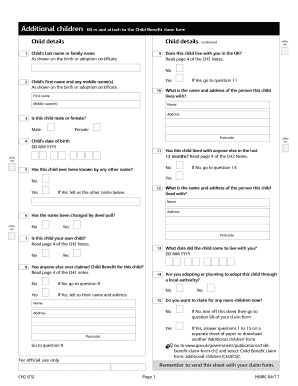

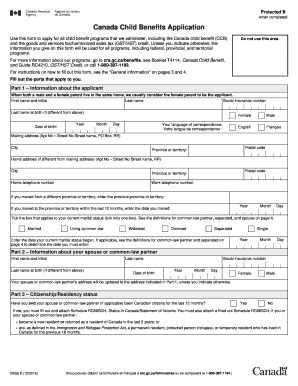

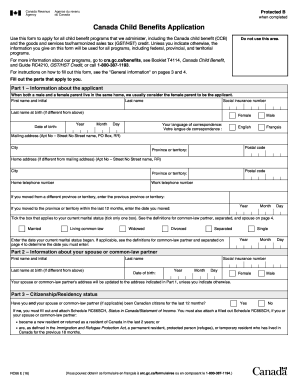

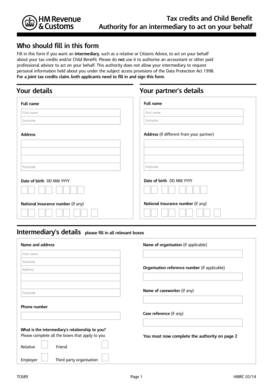

A child benefit online account is a digital platform that allows users to manage their child benefit payments and information online. It provides a convenient and efficient way to access and update personal details, track payments, and communicate with the relevant authorities. With a child benefit online account, users can easily stay up to date with their benefits and make necessary changes as needed.

What are the types of child benefit online account?

There are two types of child benefit online accounts available:

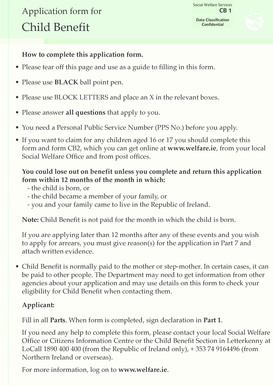

How to complete child benefit online account

Completing a child benefit online account is a simple and straightforward process. Follow these steps to get started:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.