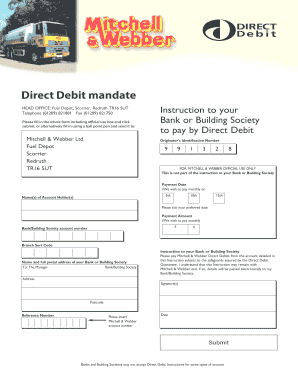

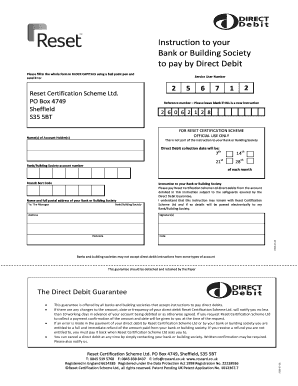

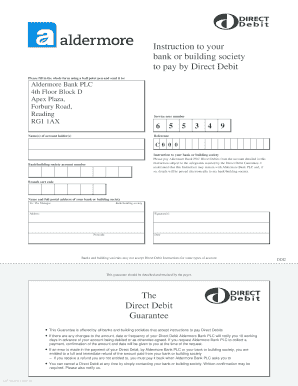

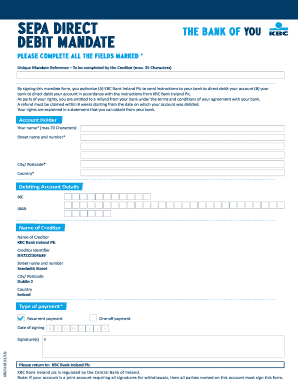

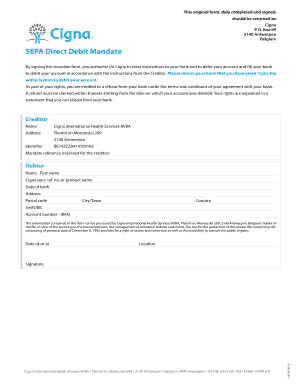

Direct Debit Mandate Form

What is direct debit mandate form?

A direct debit mandate form is a document that authorizes a company or organization to collect payments directly from your bank account. It is a convenient and secure way to make regular payments, such as utility bills or membership fees, without the need for manual transactions or reminders.

What are the types of direct debit mandate form?

There are different types of direct debit mandate forms that cater to specific purposes. Some common types include:

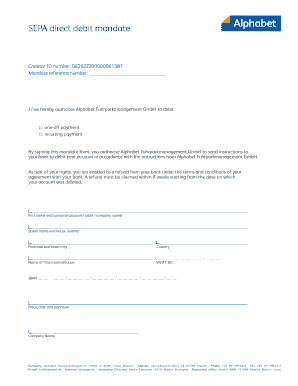

Standard Direct Debit Mandate: This is the most basic form that authorizes a company to collect payments from your bank account on a regular basis.

Variable Direct Debit Mandate: This form allows for the flexibility of collecting different amounts for each payment, such as monthly bills that vary.

Advance Notice Direct Debit Mandate: With this form, you receive advance notification of the payment amount and date before it is collected from your account.

One-time Direct Debit Mandate: As the name suggests, this form is used for a single payment, ensuring it is collected only once.

How to complete direct debit mandate form

Completing a direct debit mandate form is a simple process. Here are the steps:

01

Provide your personal information, including your name, address, and contact details. This ensures that the company can identify you as the account holder.

02

Enter your bank account details, such as the account number and sort code. This information is necessary for the company to initiate the direct debit transactions.

03

Specify the payment frequency, whether it is monthly, quarterly, or annually. This determines how often the company will collect payments from your account.

04

Indicate the payment amount or if it varies, provide instructions for how the company should determine the payment amount for each transaction.

05

Read and understand the terms and conditions of the direct debit agreement. Ensure that you agree to the terms before signing the form.

06

Sign and date the form to confirm your authorization for the direct debit transactions.

pdfFiller is an online platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller offers a comprehensive solution for all your PDF editing needs.

Video Tutorial How to Fill Out direct debit mandate form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

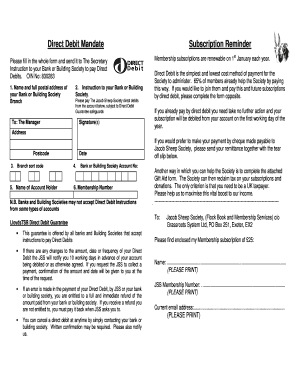

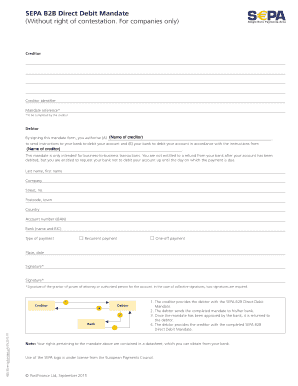

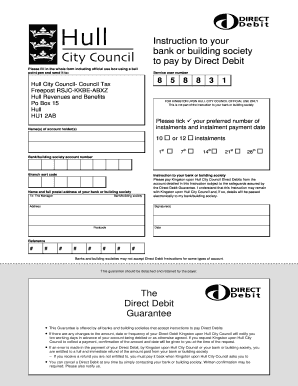

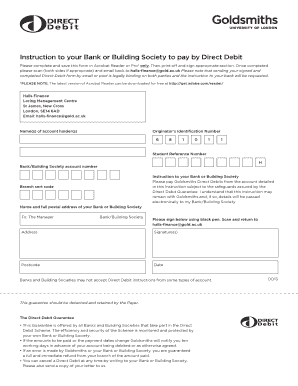

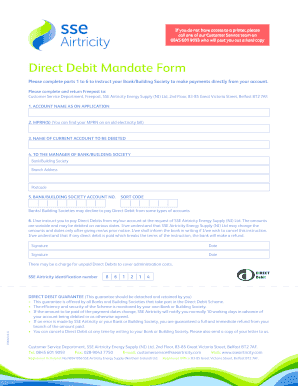

What is a Direct Debit mandate form?

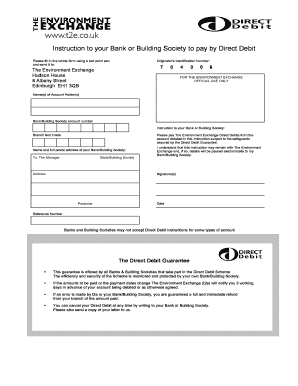

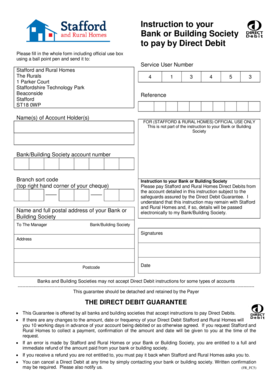

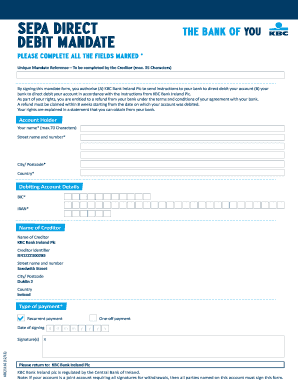

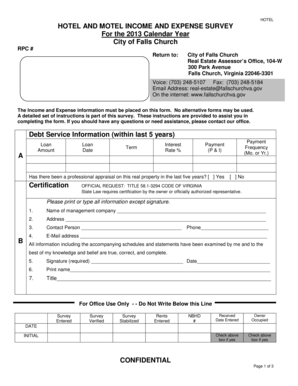

A Direct Debit mandate gives service providers written permission to take payments from their customers bank accounts. Payments cannot be collected until the mandate has been signed and agreed by the customer. Direct Debits are the safest and most trusted method of collecting recurring payments.

What is debit mandate form?

In a bank mandate, a third party will be authorised to debit a specific sum from your bank account at regular intervals. By submitting a mandate form, you authorise your bank to conduct an auto-debit transaction. In this transaction, a certain amount is drawn from your savings account on predetermined dates.

How do I fill out a mandate form?

How to Fill NACH Mandate Form? Date: Enter the date in DD/MM/YYYY format. Checkbox: To create or edit the mandate, tick the appropriate checkbox. Account Type: Tick the bank account type from the list. Account Number: Write your bank account number. IFSC / MICR Code: Fill in the code that applies.

How do I get a Direct Debit mandate form?

The three most common ways to do so are: Paper - A paper Direct Debit Instruction form can be completed by your customer and returned to you. Telephone - Your customer's details can be collected over the phone, using a bank-approved script. Online - An electronic mandate form can be completed by your customer.

How do you set up a mandate?

Click on the 'View and Generate' option for the relevant investor and bank account. On the following screen, select the 'Generate e-Mandate' option. You can set the daily limit for the e-mandate by clicking on the drop-down in front of 'Maximum per-day amount for the mandate.

Can a Direct Debit mandate be emailed?

Can we take a Direct Debit Instruction (DDI) via email? No, not by just taking their bank details in an email. You could potentially accept a scanned signed paper Direct Debit Instruction.