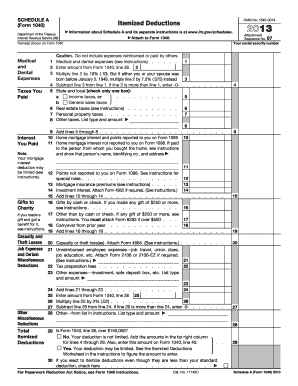

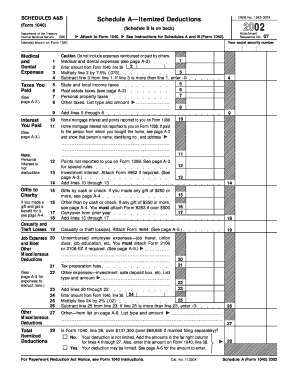

Form 1040 Schedule A

What is form 1040 schedule a?

Form 1040 Schedule A, also known as Itemized Deductions, is a form that taxpayers use to report their deductible expenses on their federal income tax return. It is an important document for individuals who choose to itemize their deductions rather than taking the standard deduction. By using Form 1040 Schedule A, taxpayers can potentially reduce their taxable income and minimize their tax liability by deducting certain eligible expenses.

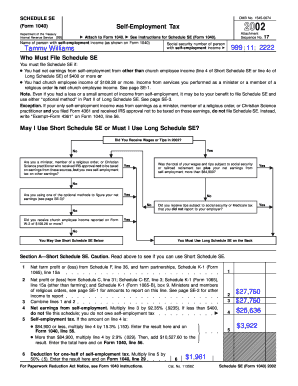

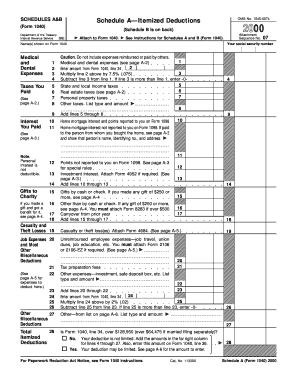

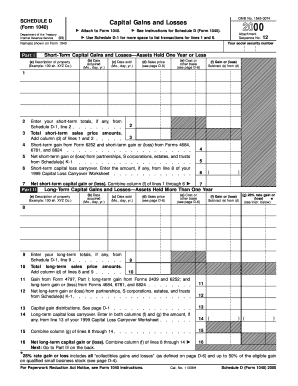

What are the types of form 1040 schedule a?

Form 1040 Schedule A covers various types of deductible expenses, including but not limited to:

How to complete form 1040 schedule a

To complete Form 1040 Schedule A, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.