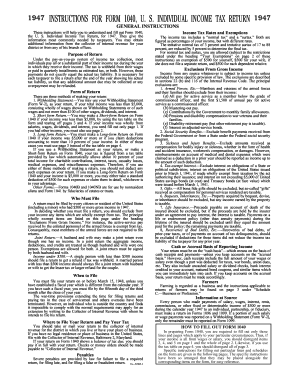

Form 1040 Instructions

What is form 1040 instructions?

Form 1040 instructions are a set of guidelines provided by the Internal Revenue Service (IRS) to help taxpayers correctly fill out their Form 1040, which is the U.S. Individual Income Tax Return. These instructions are designed to assist taxpayers in understanding the requirements and procedures for completing their tax return accurately.

What are the types of form 1040 instructions?

There are three main types of Form 1040 instructions: Form 1040 Instructions, Form 1040-A Instructions, and Form 1040-EZ Instructions. Each type of instruction is tailored to different tax situations and helps taxpayers navigate through the specific requirements and calculations associated with their individual tax return.

How to complete form 1040 instructions

Completing form 1040 instructions can seem daunting, but with the right guidance, it can be a straightforward process. Here is a step-by-step guide to help you complete your form 1040:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.