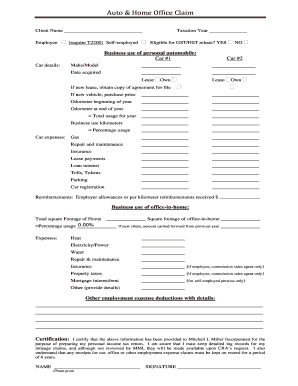

Home Office Deduction Limitation

What is home office deduction limitation?

The home office deduction limitation refers to the maximum amount that can be deducted for expenses related to a home office. This limitation is imposed by the Internal Revenue Service (IRS) and is designed to prevent abuse or excessive deductions.

What are the types of home office deduction limitation?

There are two types of home office deduction limitations: 1. Regular Method: Under this method, the deduction is calculated based on the percentage of your home used for business purposes. The total deduction is limited to the smaller of the percentage of your home used for business or the maximum square footage allowed by the IRS. 2. Simplified Method: This method allows you to deduct $5 per square foot of your home used for business, up to a maximum of 300 square feet. This provides a simpler way to calculate the deduction without the need for detailed expense records.

How to complete home office deduction limitation

Completing the home office deduction limitation requires careful consideration of your business and home expenses. Here are the steps to help you complete this deduction: 1. Calculate the percentage of your home used for business purposes using either the regular or simplified method. 2. Determine the maximum square footage allowed by the IRS for the regular method. 3. Calculate the total expenses related to your home office, including rent, mortgage interest, utilities, and maintenance costs. 4. Multiply the total expenses by the percentage of your home used for business to determine the deductible amount. 5. Compare the deductible amount to the limitation imposed by the IRS to ensure you stay within the allowed deduction. 6. Keep detailed records of your expenses and calculations in case of an audit by the IRS.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.