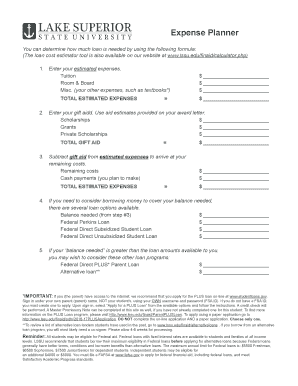

What is household budget planner?

A household budget planner is a tool that helps individuals or families track and manage their income and expenses. It allows users to create a comprehensive budget by categorizing their expenses and setting financial goals. With a household budget planner, users can gain better visibility into their financial standing, identify areas where they can save money, and make informed decisions about their spending habits.

What are the types of household budget planner?

There are several types of household budget planners available to cater to different preferences and needs. Some of the common types include:

Excel or spreadsheet-based budget planners: These are digital templates or spreadsheets that users can customize and use to track their income and expenses.

Mobile apps: Many budgeting apps are available on smartphones, providing users with easy access to their budget information on the go.

Online budgeting tools: These are web-based platforms or websites that offer budgeting functionalities and allow users to store and analyze their financial data online.

Printable budget planners: Some individuals prefer physical budget planners that they can print and fill out manually.

How to complete household budget planner

Completing a household budget planner is a simple process that can greatly benefit your financial management. Here are the steps to complete a household budget planner:

01

Gather all your financial information: Collect important documents such as bank statements, pay stubs, bills, and receipts. This will help you accurately track your income and expenses.

02

Categorize your income and expenses: Create categories for different types of income and expenses, such as rent/mortgage, groceries, utilities, transportation, and entertainment. Assign the relevant amounts to each category.

03

Set financial goals: Determine your short-term and long-term financial goals, such as saving for a vacation or paying off debt. Set realistic targets and allocate funds accordingly.

04

Track your actual expenses: Regularly update your budget planner with your actual expenses to keep track of your spending. This will help you identify any deviations from your planned budget.

05

Review and adjust: Periodically evaluate your budget and make necessary adjustments. Analyze your spending patterns and find areas where you can cut back to achieve your financial goals.

06

Utilize pdfFiller for easy budget planning: Try using pdfFiller, an online platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to streamline your budget planning process.

By following these steps and utilizing a household budget planner, you can take control of your finances and work towards achieving financial stability.