Budgeting Worksheets For Students

What is budgeting worksheets for students?

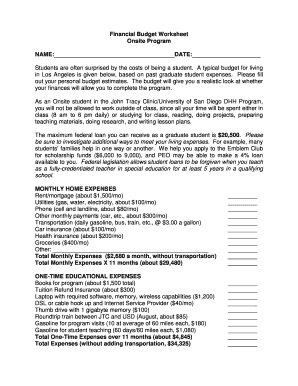

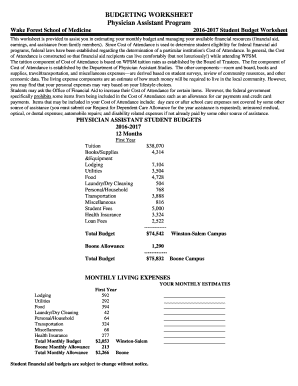

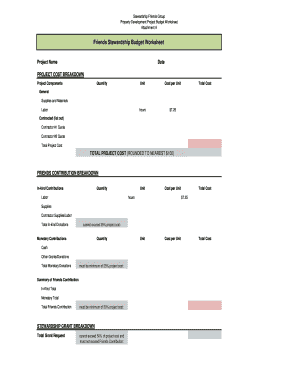

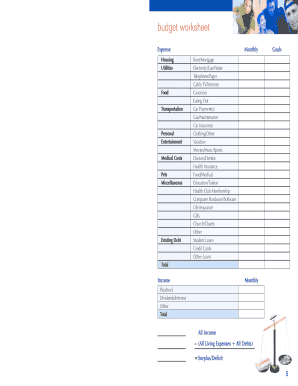

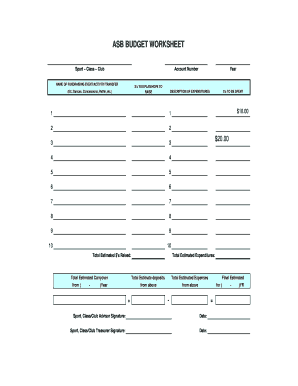

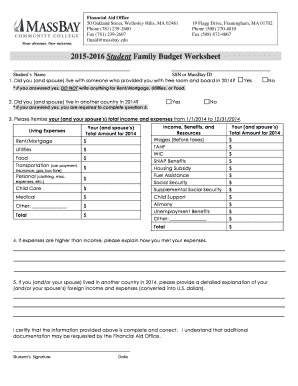

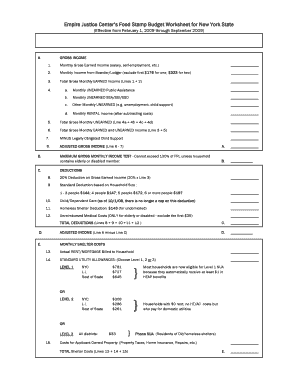

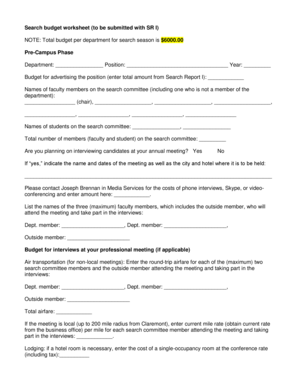

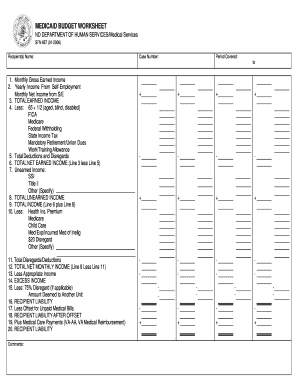

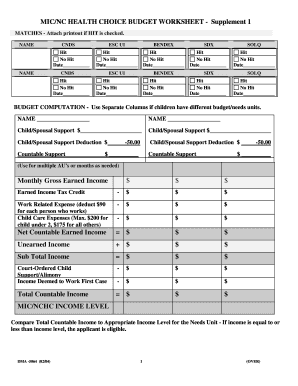

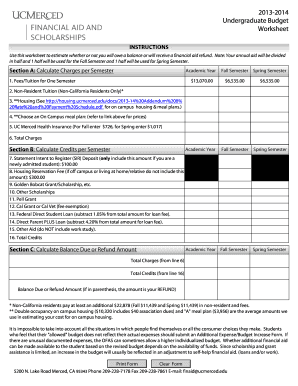

Budgeting worksheets for students are tools that help students plan and track their finances. These worksheets typically include categories for income, expenses, savings, and goals. By using budgeting worksheets, students can develop important money management skills, track their spending habits, and work towards achieving their financial goals.

What are the types of budgeting worksheets for students?

There are several types of budgeting worksheets available for students:

How to complete budgeting worksheets for students

Completing budgeting worksheets for students is a simple process that can help them gain better control over their finances. Here are the steps to complete budgeting worksheets:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.