What is Household Budget Template?

A Household Budget Template is a tool used to track and manage a household's income and expenses. It helps individuals and families organize their finances, allocate funds for various needs, and monitor their spending habits. By creating a budget, users can gain a better understanding of their financial situation and make informed decisions about saving, investing, and spending.

What are the types of Household Budget Template?

There are several types of Household Budget Templates available to suit different needs and preferences. Some common types include:

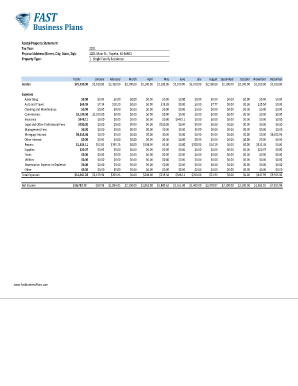

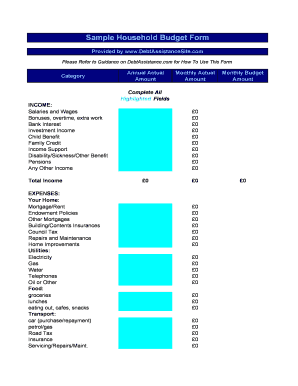

Monthly Budget Template: This template helps users track their income and expenses on a monthly basis.

Weekly Budget Template: This template is useful for individuals who prefer to manage their finances on a weekly basis.

Annual Budget Template: This template allows users to plan their budget for an entire year.

Bi-Weekly Budget Template: This template is designed for individuals who receive their income every two weeks.

How to complete Household Budget Template

Completing a Household Budget Template is a straightforward process. Follow these steps to effectively manage your finances:

01

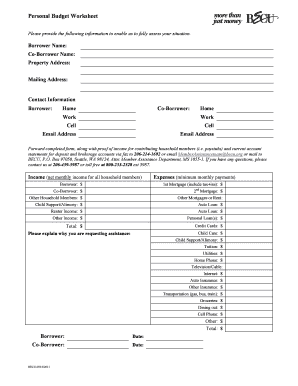

Gather all your financial documents, such as bank statements, bills, and pay stubs.

02

Determine your income sources, including salaries, investments, and any other sources of income.

03

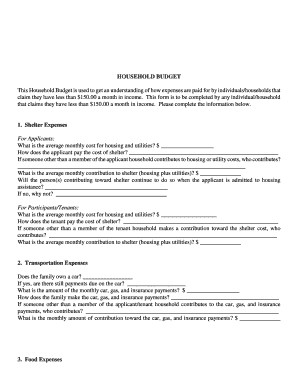

Categorize your expenses by grouping them into specific categories like housing, transportation, groceries, entertainment, etc.

04

Input your income and expenses into the respective sections of the template.

05

Calculate your total income and total expenses.

06

Analyze your budget by comparing your income and expenses. Make adjustments if necessary.

07

Set financial goals and allocate funds accordingly.

08

Regularly review and update your budget to ensure it reflects your current financial situation.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.