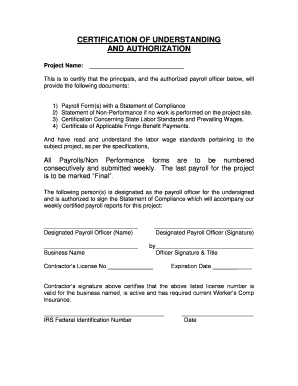

No Work Performed Certified Payroll Form

What is no work performed certified payroll form?

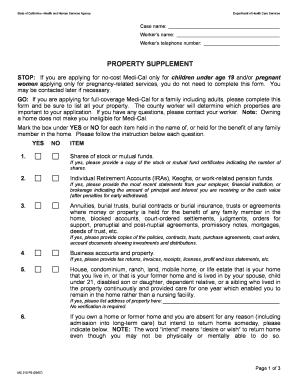

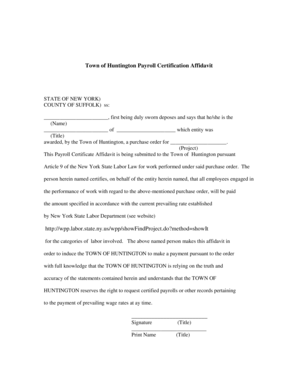

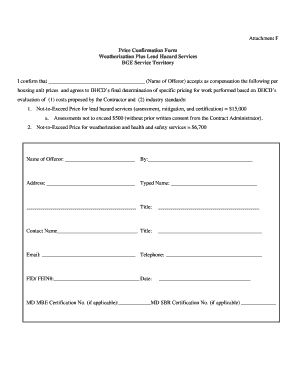

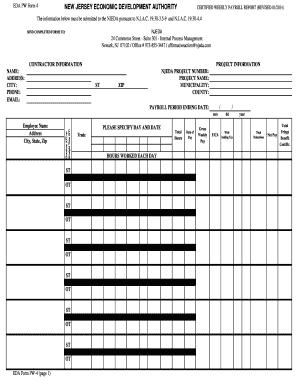

A no work performed certified payroll form is a document that allows contractors and subcontractors to certify that no work was performed by their employees on a specific project or job site during a specific period of time. It is typically required by government agencies or project owners as part of their compliance and reporting procedures.

What are the types of no work performed certified payroll form?

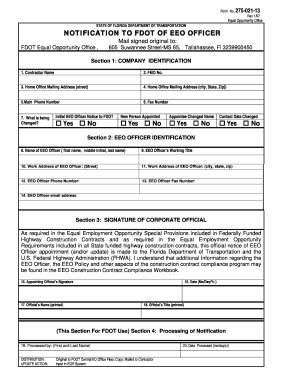

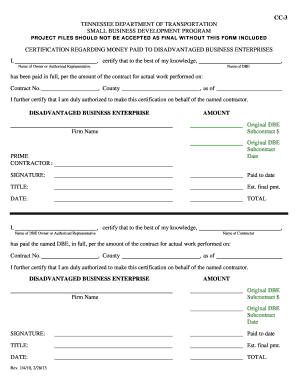

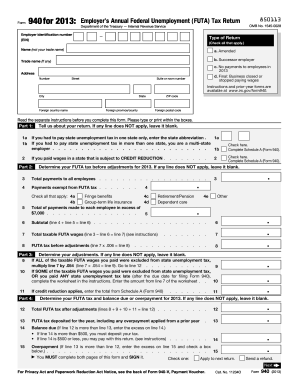

There are two common types of no work performed certified payroll forms: the federal form and the state-specific form. The federal form is used for projects that fall under federal funding or federal government contracts, while the state-specific form is used for projects funded or contracted by state agencies. The specific requirements and format of these forms may vary depending on the jurisdiction.

How to complete no work performed certified payroll form

Completing a no work performed certified payroll form is a straightforward process. Here are the general steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.