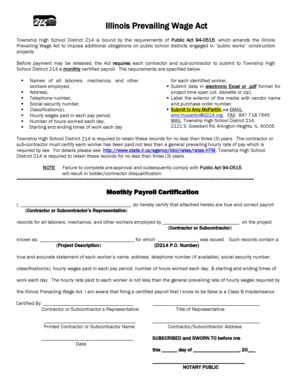

Certified Payroll Forms Excel Format

What is certified payroll forms excel format?

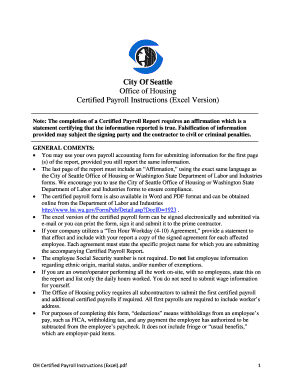

Certified payroll forms excel format refers to a specific format used for creating payroll documents in Microsoft Excel. These forms are designed to capture and record important payroll information in a structured and organized manner. By using the excel format, employers can easily calculate wages, hours worked, deductions, and other relevant details for their employees. This format provides a convenient and efficient way to manage payroll processes.

What are the types of certified payroll forms excel format?

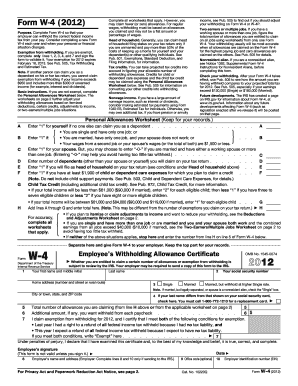

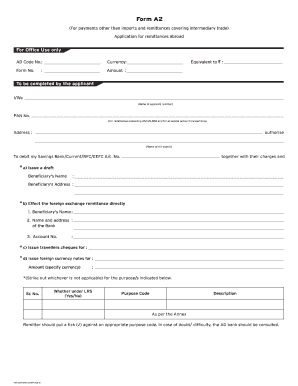

There are several types of certified payroll forms available in excel format, each serving a specific purpose. The most common types include:

How to complete certified payroll forms excel format

Completing certified payroll forms in excel format is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.