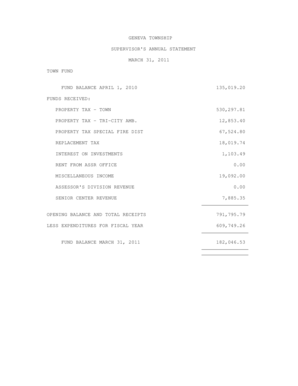

Opening Balance Entry

What is opening balance entry?

An opening balance entry is a financial record that represents the initial amount of money or value in an account at the start of a specific accounting period. It is usually recorded when a company or individual sets up a new account or begins a new financial period. This entry is important as it helps establish a starting point for future transactions and financial calculations.

What are the types of opening balance entry?

There are several types of opening balance entry, including:

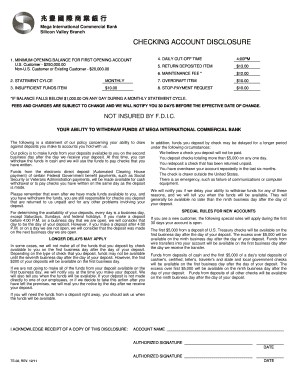

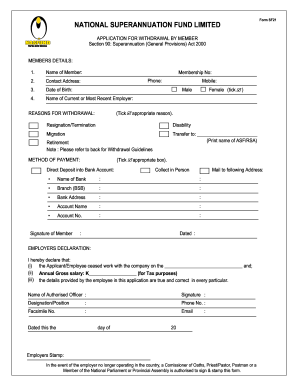

Opening balance for cash accounts

Opening balance for bank accounts

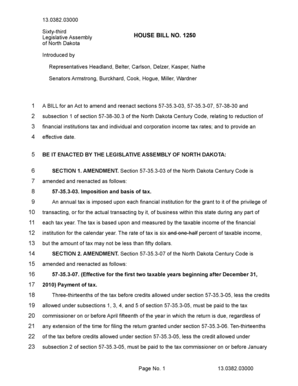

Opening balance for asset accounts

Opening balance for liability accounts

Opening balance for equity accounts

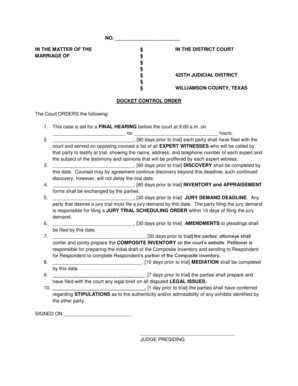

How to complete opening balance entry

To complete an opening balance entry, follow these steps:

01

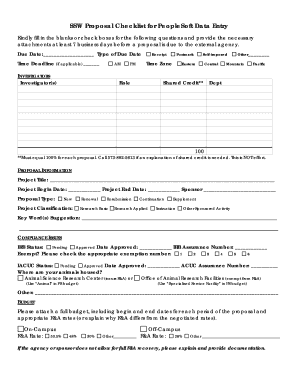

Gather all relevant financial statements and records, such as balance sheets and transaction histories.

02

Identify the specific accounts for which you need to record opening balances.

03

Determine the amount or value that represents the opening balance for each account.

04

Record the opening balances in the appropriate accounts, using the correct accounting software or system.

05

Double-check all entries for accuracy and make necessary adjustments if needed.

It is important to note that pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out opening balance entry

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Related templates