California Certified Payroll Form

What is california certified payroll form?

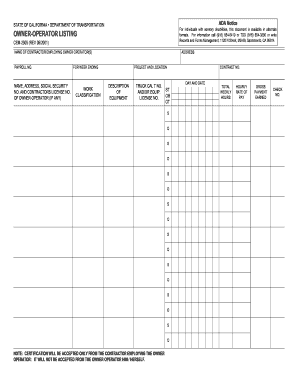

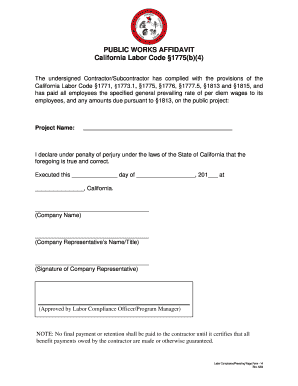

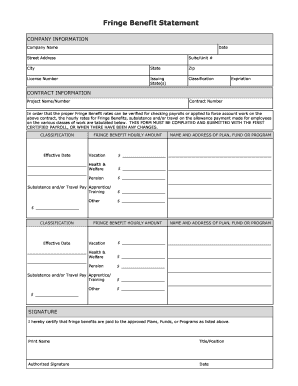

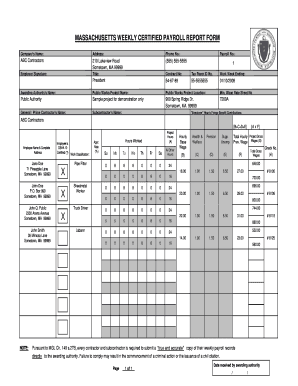

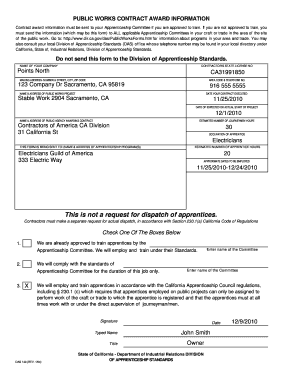

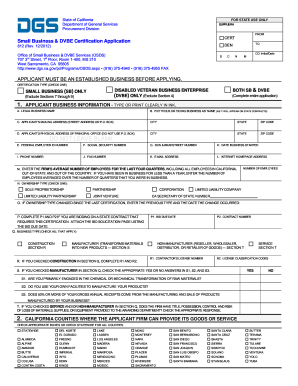

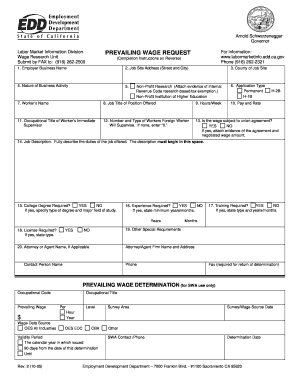

The California certified payroll form is a document that employers are required to submit to the state's Labor Commissioner. It provides detailed information about the wages paid to employees, their job classifications, and the number of hours worked. This form helps ensure that employees are being paid properly and that labor laws are being followed.

What are the types of california certified payroll form?

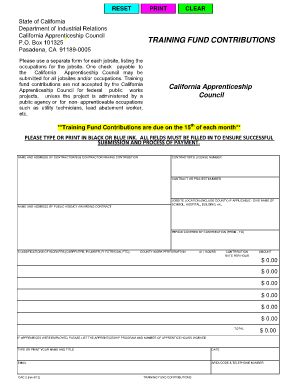

There are two main types of California certified payroll forms: 1. Form A: This form is used for public works projects where the total project cost is $25,000 or less. It requires basic information about the project, including the name of the contractor and the estimated cost. 2. Form B: This form is used for public works projects where the total project cost exceeds $25,000. It requires more detailed information, such as the names and classifications of all workers, their hourly rates of pay, and the number of hours worked each day.

How to complete california certified payroll form

Completing the California certified payroll form is a straightforward process. Here are the steps to follow: 1. Obtain the correct form: Make sure you have the appropriate form for your project's total cost. 2. Fill in the basic information: Provide the necessary information about the project, including the name of the contractor and the estimated cost. 3. Enter employee details: For each worker, include their name, job classification, hourly rate of pay, and the number of hours worked each day. 4. Double-check for accuracy: Review the completed form to ensure all information is accurate and up-to-date. 5. Submit the form: File the completed form with the California Labor Commissioner according to the specified guidelines.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.