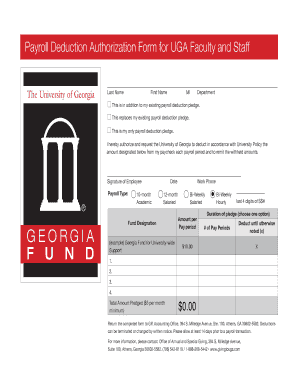

Payroll Deduction Authorization Form California

What is payroll deduction authorization form California?

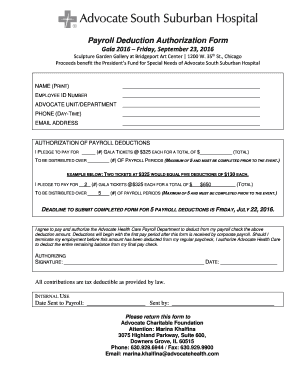

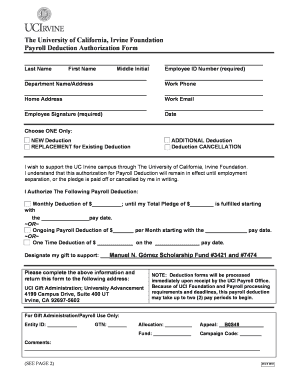

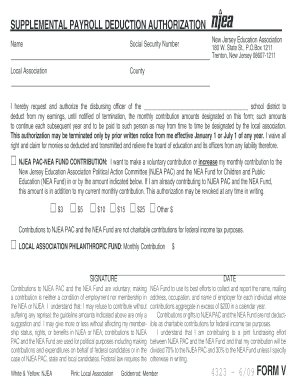

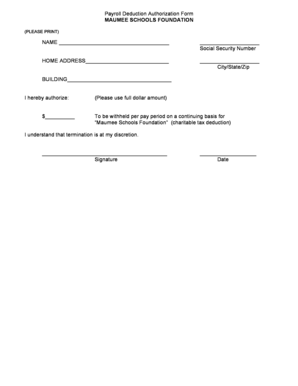

A payroll deduction authorization form California is a legal document that allows an employer to deduct specific amounts from an employee's wages for various purposes, such as taxes, insurance premiums, or retirement contributions. This form ensures that both the employer and the employee are aware of the deductions and agree to them. It serves as a written authorization and protects the rights of both parties involved.

What are the types of payroll deduction authorization form California?

There are several types of payroll deduction authorization forms in California, depending on the purpose of the deduction. Some common types include: 1. Tax Deduction Authorization Form: This form allows the employer to deduct federal, state, and local taxes from an employee's wages. 2. Insurance Deduction Authorization Form: This form authorizes the employer to deduct insurance premiums from the employee's salary. 3. Retirement Deduction Authorization Form: This form grants the employer permission to deduct retirement contributions from the employee's wages. 4. Wage Garnishment Authorization Form: This form is used when a court orders an employer to deduct a portion of an employee's wages to satisfy a debt. Please note that these are just a few examples, and there may be other types of deduction authorization forms depending on the specific circumstances.

How to complete payroll deduction authorization form California?

Completing a payroll deduction authorization form California is a straightforward process. Here are the steps to follow: 1. Obtain the form: Ask your employer or payroll department for the specific payroll deduction authorization form relevant to your situation. 2. Provide personal information: Fill in your full name, employee identification number (if applicable), address, and other necessary personal details as requested on the form. 3. Specify the deduction details: Clearly indicate the type of deduction you authorize, such as taxes, insurance premiums, or retirement contributions. Provide any additional information or instructions as required. 4. Review and sign: Carefully review the form for accuracy and ensure that all necessary sections are completed. Sign the form to indicate your consent and agreement to the deductions. 5. Retain a copy: Make sure to keep a copy of the completed form for your records. By following these steps, you can efficiently complete a payroll deduction authorization form in California.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.