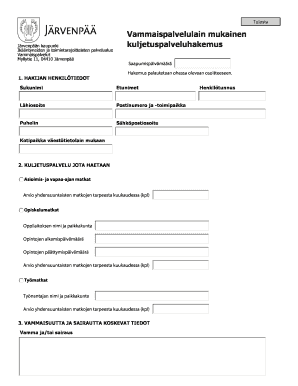

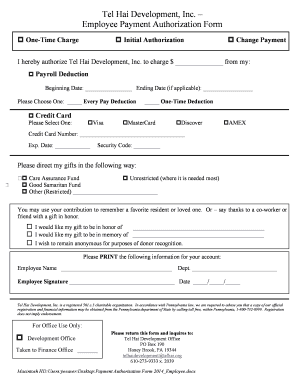

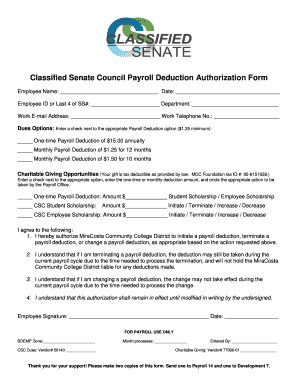

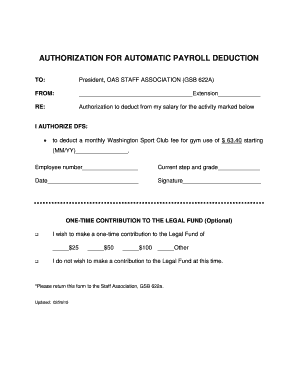

One Time Payroll Deduction Authorization Form

What is one time payroll deduction authorization form?

A one time payroll deduction authorization form is a document that allows an employee to authorize a one-time deduction from their payroll. This deduction can be made for various reasons, such as purchasing company products or services, making charitable donations, or repaying a loan.

What are the types of one time payroll deduction authorization form?

There are several types of one time payroll deduction authorization forms available, including:

Employee Purchase Deduction Form

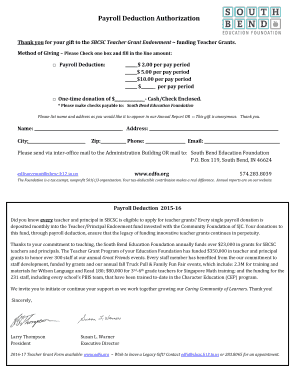

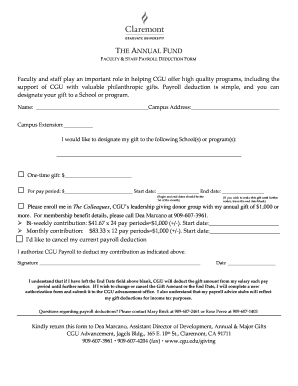

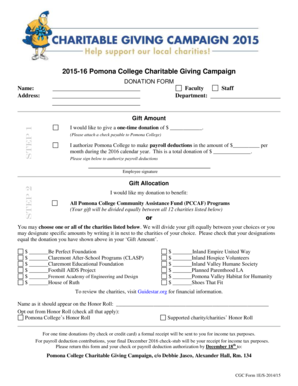

Charitable Donation Deduction Form

Loan Repayment Deduction Form

How to complete one time payroll deduction authorization form

To complete a one time payroll deduction authorization form, follow these steps:

01

Fill in your personal information, including your name, employee ID, and contact details.

02

Specify the reason for the one-time deduction and provide any additional details required.

03

Indicate the amount or percentage to be deducted from your payroll.

04

Sign and date the form to authorize the deduction.

05

Submit the completed form to the appropriate department or person for processing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Related templates