W-9 Instructions

What is w-9 instructions?

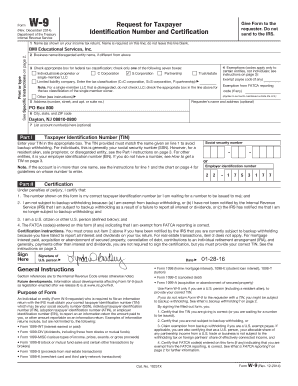

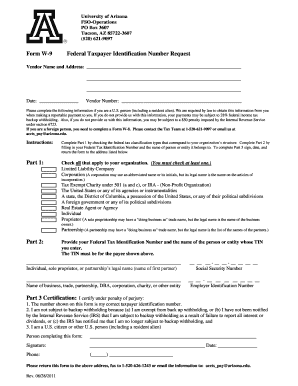

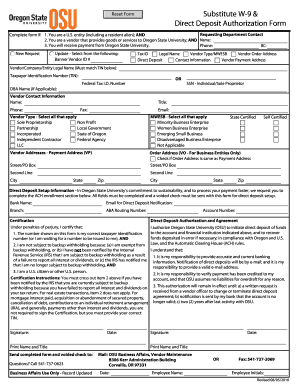

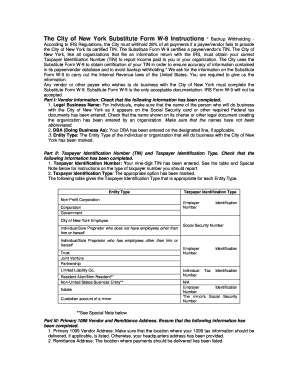

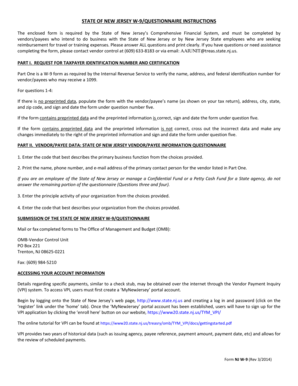

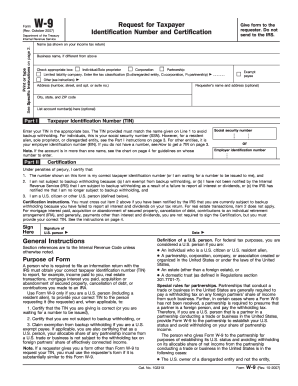

W-9 instructions refer to the guidelines and information provided by the Internal Revenue Service (IRS) for completing and submitting the W-9 form. The W-9 form is used to obtain taxpayer identification numbers (TIN) for individuals and businesses. It is required by payers to accurately report the income paid to recipients, such as independent contractors or freelancers. The W-9 instructions provide detailed explanations and examples to help taxpayers understand the requirements and correctly fill out the form.

What are the types of w-9 instructions?

The types of W-9 instructions include general instructions for the W-9 form, specific instructions for individual taxpayers, specific instructions for corporations, partnerships, and other entities, as well as additional guidance for certain situations. The general instructions cover the basic information needed for completing the form, while the specific instructions provide detailed explanations for particular situations or taxpayer categories. These instructions ensure that the correct information is provided and help taxpayers avoid errors or omissions on the form.

How to complete w-9 instructions

Completing W-9 instructions involves several steps to ensure accurate and timely submission of the form. Here is a step-by-step guide:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.