Get the free STATE OF NEW JERSEY W-9/QUESTIONNAIRE INSTRUCTIONS - judiciary state nj

Show details

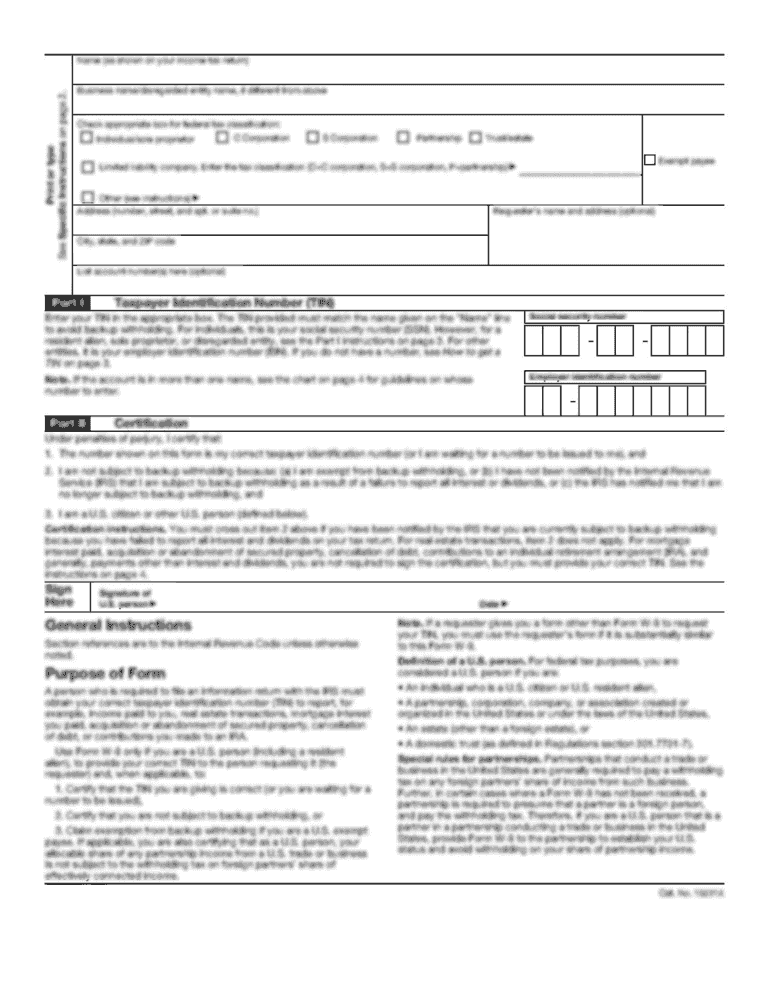

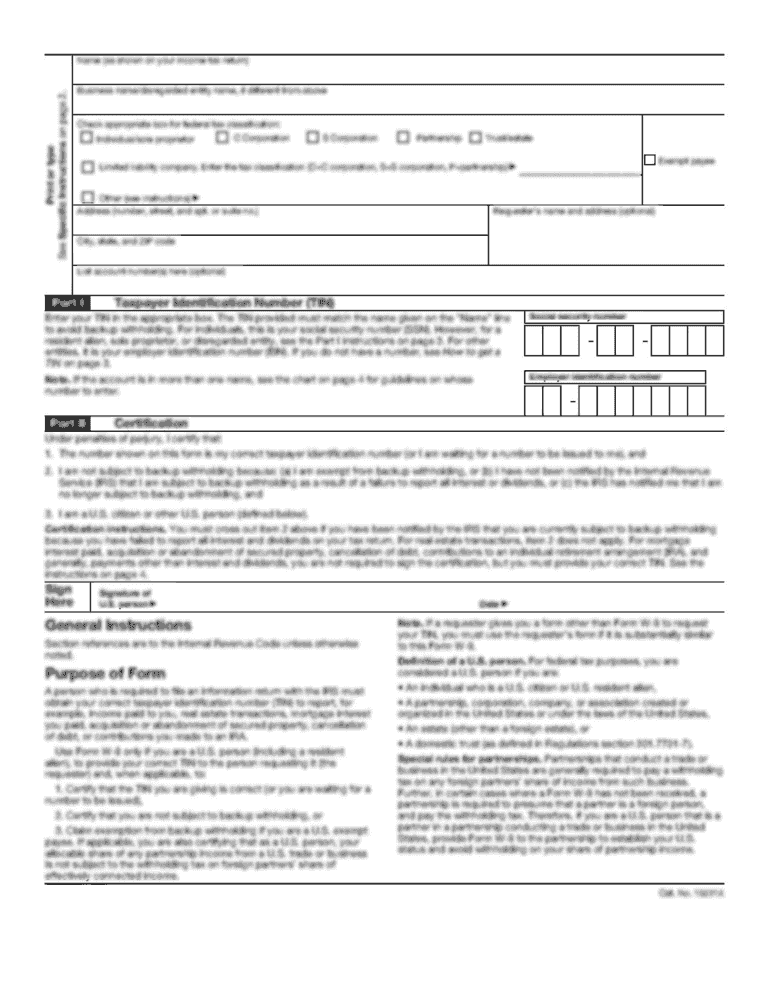

STATE OF NEW JERSEY W-9/QUESTIONNAIRE INSTRUCTIONS The enclosed form is required by the State of New Jersey s Comprehensive Financial System, and must be completed by vendors/payees who intend to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your state of new jersey form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state of new jersey form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state of new jersey online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit state of new jersey. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out state of new jersey

How to fill out state of new jersey:

01

Begin by gathering all the necessary information and documents required to complete the state of New Jersey form.

02

Fill out your personal details accurately, including your full name, address, and contact information.

03

Provide any additional information or documentation that may be required, such as proof of identification, proof of residency, or tax information.

04

Follow the instructions on the form carefully, ensuring that all sections are properly completed and any required signatures are obtained.

05

Double-check your entries for accuracy and completeness before submitting the completed state of New Jersey form.

Who needs state of New Jersey:

01

Residents of New Jersey who are eligible for and require various state services, benefits, or programs may need to fill out the state of New Jersey form.

02

Individuals or businesses seeking to comply with state tax obligations or register for state licenses or permits would also need this form.

03

Certain legal proceedings or transactions may require the completion of specific state of New Jersey forms to meet legal requirements or obtain official documentation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is state of new jersey?

The state of New Jersey is a state located on the East Coast of the United States.

Who is required to file state of new jersey?

Individuals and businesses that have a tax presence in the state of New Jersey are required to file a state tax return.

How to fill out state of new jersey?

To fill out a state of New Jersey tax return, you can use tax preparation software, hire a tax professional, or fill out the forms manually using the instructions provided by the New Jersey Division of Taxation.

What is the purpose of state of new jersey?

The purpose of the state of New Jersey tax return is to report an individual's or business's income, calculate any applicable tax liability, and determine if a refund is due.

What information must be reported on state of new jersey?

The specific information that must be reported on a state of New Jersey tax return includes income earned in New Jersey, deductions, credits, and any other relevant tax information.

When is the deadline to file state of new jersey in 2023?

The deadline to file a state of New Jersey tax return for the year 2023 is April 17, 2023.

What is the penalty for the late filing of state of new jersey?

The penalty for the late filing of a state of New Jersey tax return is generally 5% of the unpaid tax per month, up to a maximum penalty of 25%. However, penalties and interest may vary depending on the specific circumstances.

How do I modify my state of new jersey in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your state of new jersey along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an electronic signature for signing my state of new jersey in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your state of new jersey and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I fill out state of new jersey on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your state of new jersey from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your state of new jersey online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.