Insurance Claim Template Excel

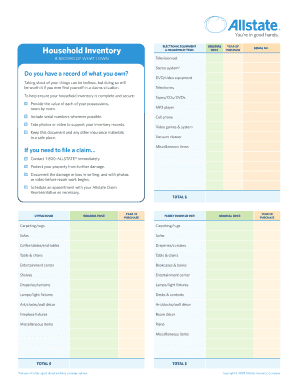

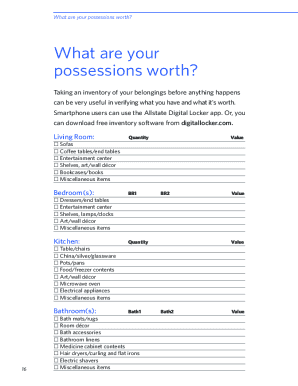

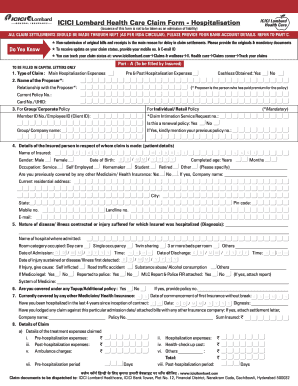

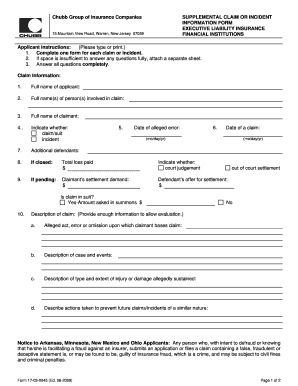

What is Insurance claim template excel?

Insurance claim template excel is a pre-designed spreadsheet that helps individuals or businesses to document and calculate their insurance claims in an organized manner. It simplifies the process and ensures accuracy in the calculations.

What are the types of Insurance claim template excel?

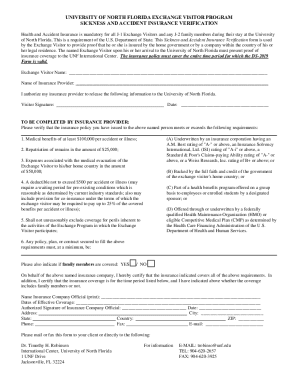

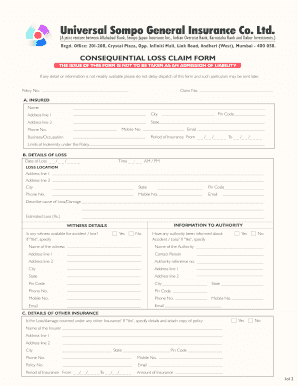

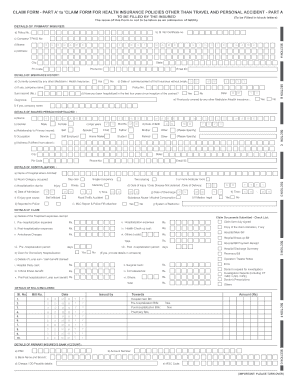

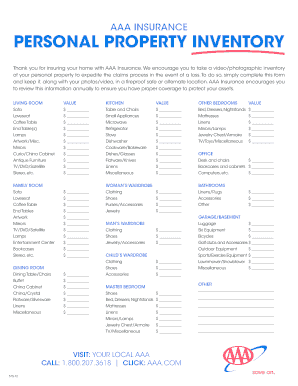

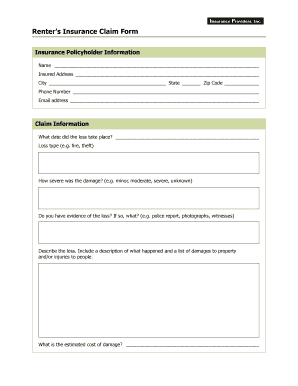

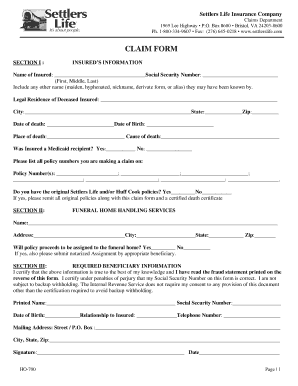

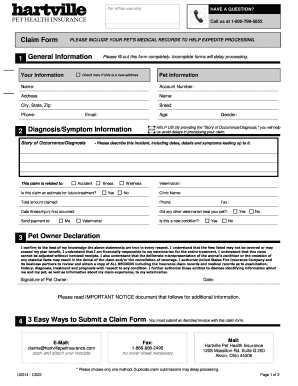

There are several types of Insurance claim template excel available, including: 1. Property insurance claim template 2. Health insurance claim template 3. Auto insurance claim template 4. Travel insurance claim template 5. Life insurance claim template

How to complete Insurance claim template excel

Completing an Insurance claim template excel is simple and straightforward. Follow these steps: 1. Download the template and open it in Microsoft Excel 2. Fill in your personal or business information accurately 3. Enter details of the insurance policy and coverage 4. Document the incident or reason for the claim 5. Input the estimated or actual expenses incurred 6. Double-check all the information for accuracy before submitting

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.