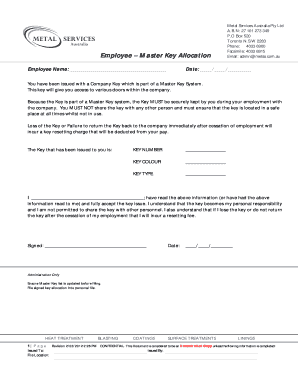

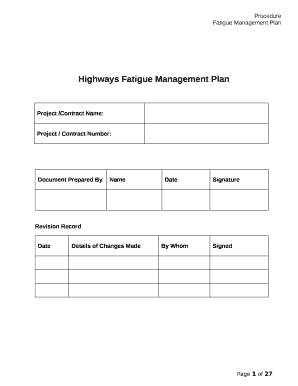

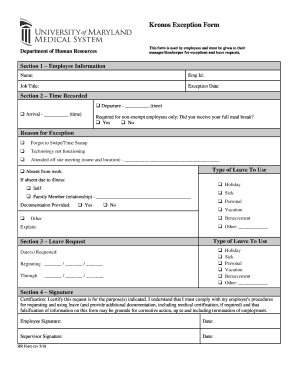

It Asset Allocation Form For Employees

What is It asset allocation form for employees?

The IT asset allocation form for employees is a document used to track and manage the allocation of IT resources to employees within an organization. This form helps ensure that employees have the necessary equipment and software to perform their job duties effectively.

What are the types of It asset allocation form for employees?

There are several types of IT asset allocation forms for employees, including:

Hardware allocation form

Software allocation form

Accessories allocation form

Mobile device allocation form

How to complete It asset allocation form for employees

Completing the IT asset allocation form for employees is a straightforward process. Here are the steps to follow:

01

Gather all necessary information such as employee name, department, position, and IT resources requested

02

Fill out the form accurately and completely

03

Submit the form to the IT department for approval and processing

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out It asset allocation form for employees

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the IRS form for asset allocation?

Both the seller and purchaser of a group of assets that makes up a trade or business must use Form 8594 to report such a sale if: goodwill or going concern value attaches, or could attach, to such assets and. the purchaser's basis in the assets is determined only by the amount paid for the assets.

What is allocation for tax purposes?

Comprehensive tax allocation is an analysis that companies use to identify discrepancies between their accounting for business purposes and their accounting for tax purposes. Most of the discrepancies result from differences between the periods used for financial reporting and tax filing.

Who fills out Form 8594?

Generally, both the purchaser and seller must file Form 8594 and attach it to their income tax returns (Forms 1040, 1041, 1065, 1120, 1120-S, etc.)

What is the IRS form for allocation of purchase price?

IRS Form 8594 requires that both parties allocate the purchase price among the various assets of the business being purchased so the seller can calculate the taxes due upon the sale, and the buyer can calculate the new basis in the assets.

What is asset allocation form?

An asset allocation form is a questionnaire that is used to help investors determine which investment portfolio is right for their assets.

Related templates