Employee Asset Form Template

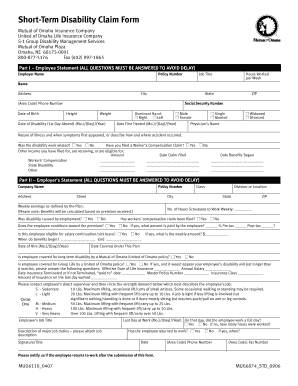

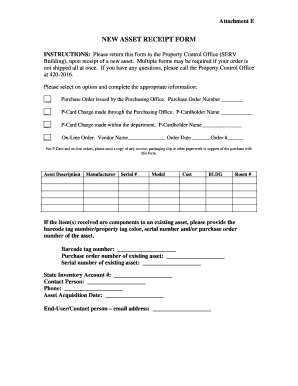

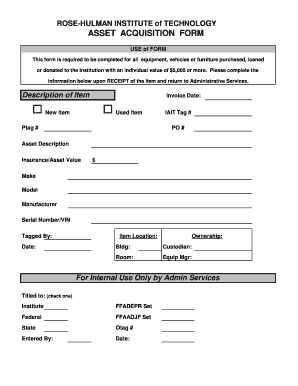

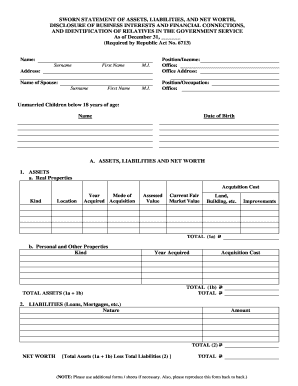

What is Employee asset form template?

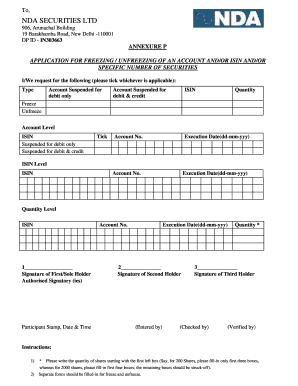

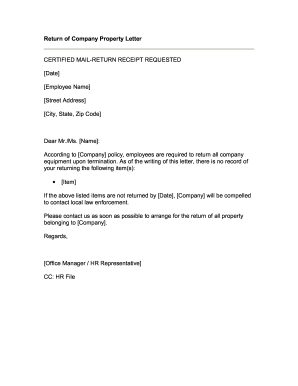

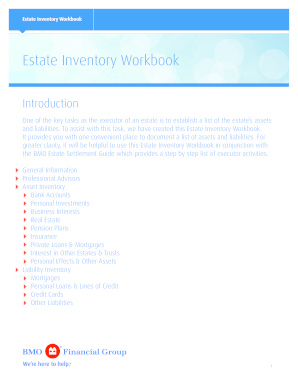

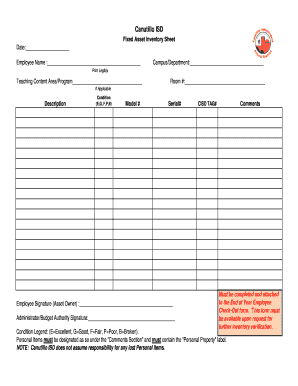

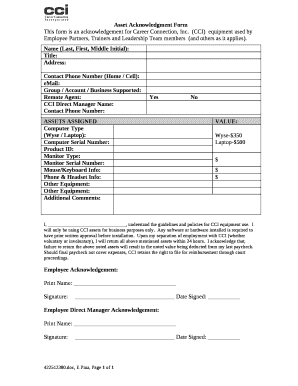

The Employee asset form template is a document that helps organizations keep track of the assets issued to their employees. It includes details such as equipment, devices, or tools provided to employees for work purposes.

What are the types of Employee asset form template?

There are different types of Employee asset form templates based on the nature of the assets being issued. Some common types include:

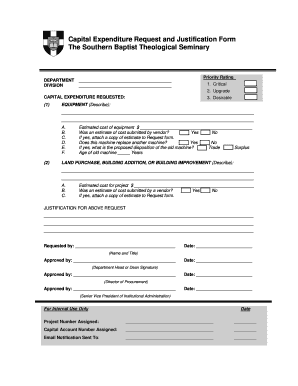

Technology assets form template

Equipment assets form template

Tool assets form template

How to complete Employee asset form template

Completing an Employee asset form template is easy and straightforward. Follow these steps:

01

Gather all necessary information about the assets being issued

02

Fill in the employee details including name, department, and position

03

List down all assets being provided with their respective details such as serial numbers and conditions

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Employee asset form template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the IRS form for allocation of purchase price?

IRS Form 8594 requires that both parties allocate the purchase price among the various assets of the business being purchased so the seller can calculate the taxes due upon the sale, and the buyer can calculate the new basis in the assets.

Are employees an asset or a liability?

By definition, employees are not assets since companies do not have control over them. Workers must convert raw materials – be they commodities or blank computer screens – into finished inventory to be paid, but if these workers want to quit, they can take their skills and training with them.

What is the IRS form for asset allocation?

Both the seller and purchaser of a group of assets that makes up a trade or business must use Form 8594 to report such a sale if: goodwill or going concern value attaches, or could attach, to such assets and. the purchaser's basis in the assets is determined only by the amount paid for the assets.

Who fills out Form 8594?

Generally, both the purchaser and seller must file Form 8594 and attach it to their income tax returns (Forms 1040, 1041, 1065, 1120, 1120-S, etc.)

What is the purpose of asset handover form?

An asset handover form is used to document the transfer of property, assets, and equipment from one person or party to another. It serves to clearly detail the items that are being transferred and to acknowledge that the transfer has taken place.

What is asset allocation form?

An asset allocation form is a questionnaire that is used to help investors determine which investment portfolio is right for their assets.

Related templates