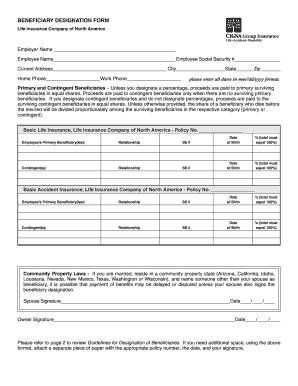

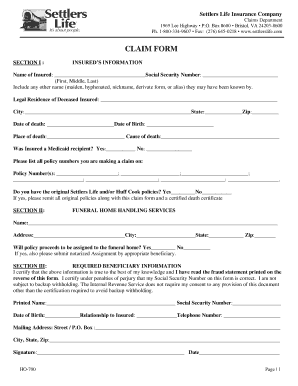

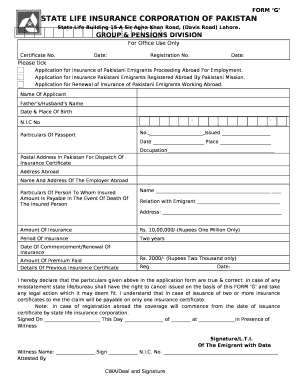

Life Insurance Application Form Templates

What are Life Insurance Application Form Templates?

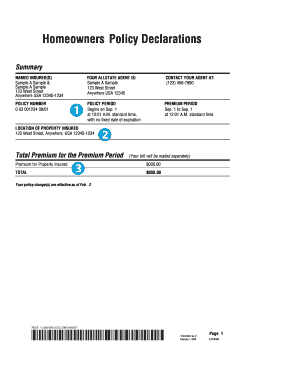

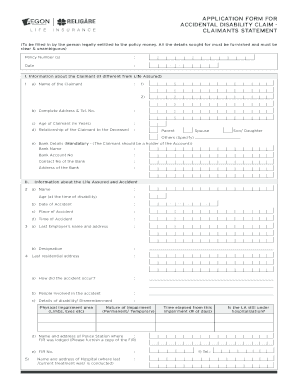

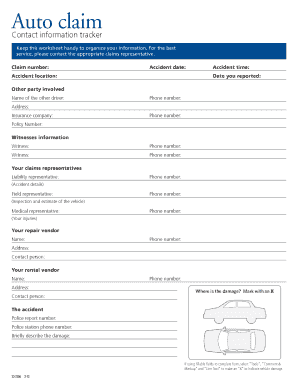

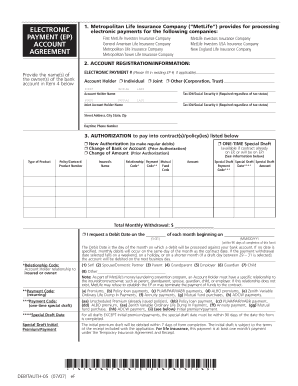

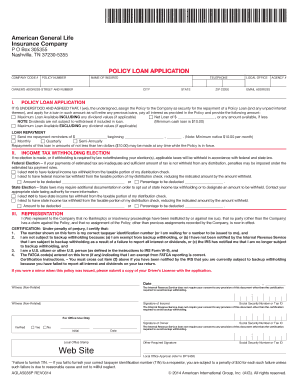

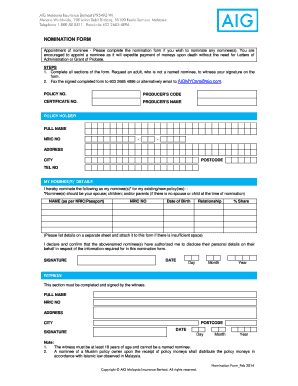

Life Insurance Application Form Templates are pre-designed documents that individuals fill out to apply for a life insurance policy. These templates help streamline the application process by providing a structured format for capturing the necessary information.

What are the types of Life Insurance Application Form Templates?

There are several types of Life Insurance Application Form Templates available, including:

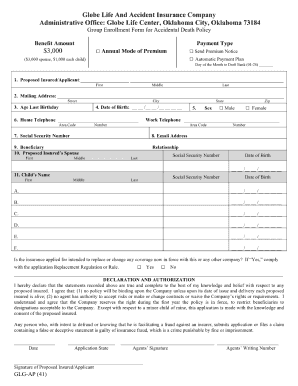

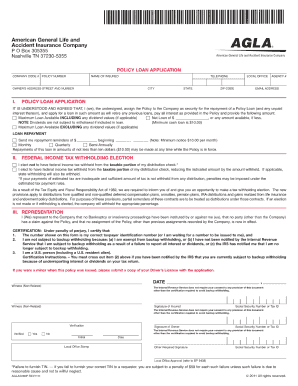

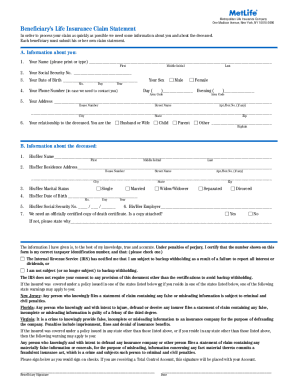

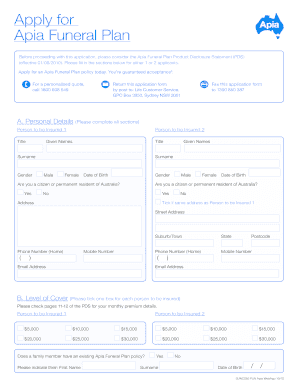

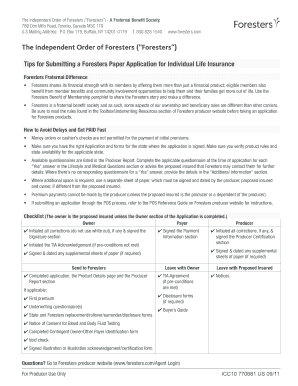

Individual Life Insurance Application Form Template

Group Life Insurance Application Form Template

Term Life Insurance Application Form Template

Whole Life Insurance Application Form Template

How to complete Life Insurance Application Form Templates

Completing a Life Insurance Application Form Template is easy and straightforward. Here are some steps to help you fill out the form:

01

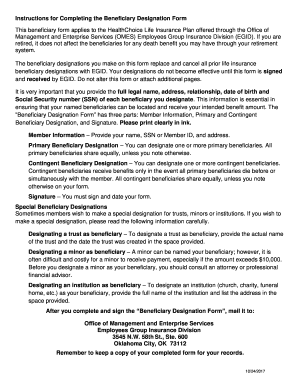

Gather all necessary information such as personal details, medical history, and beneficiary information.

02

Carefully read through the form instructions to ensure accurate completion.

03

Fill in the required fields accurately and truthfully.

04

Review the completed form for any errors or missing information before submitting.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Life Insurance Application Form Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is an insurance application part of the insurance contract?

In many cases, such as life insurance, the written application becomes part of the policy. Occasionally, before an oral or written property/casualty application is processed into a policy, a temporary contract, or binder, may be issued.

What is the insurance application?

The insurance application will inquire about your health as well as your family's history of health. It is important that you list this information as accurately as possible because this will help to determine the amount you will pay per month (known as premiums) if you are approved for the policy.

What is insurance application form?

Application for Insurance means all documents, materials, statements and exhibits, whether or not prepared by the Insured, submitted to the Company by or on behalf of the Insured for the purpose of obtaining a Commitment of Insurance or a Certificate of Insurance.

What are statements made on an insurance application?

Representation is a statement made in an application for insurance that the prospective insured represents as being correct to the best of their knowledge.

Does an insurance application have to be signed?

Sign your name Because the life insurance application is a legal document. It can be used against you if you have intentionally misreported anything, which the insurer would consider fraud.

What information is on a life insurance application?

What type of information is requested on the application? There is a series of questions on the application that provide information for underwriting the policy. These questions include name, address, age, height, weight, sex, occupation, earnings, beneficiary, insurance history and medical history.

Related templates