Life Insurance Application Form Pdf

What is Life insurance application form pdf?

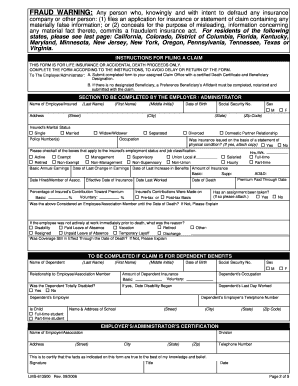

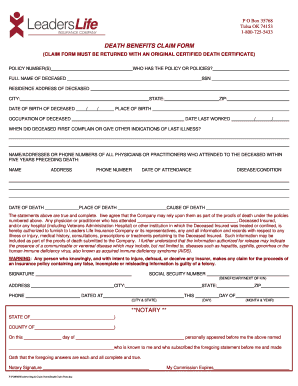

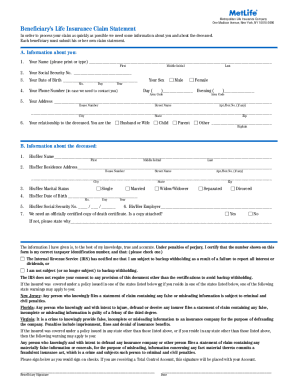

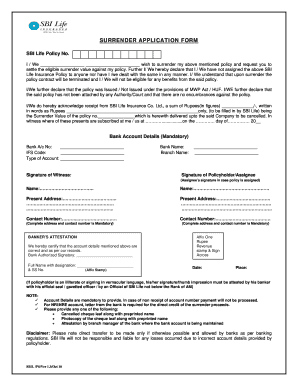

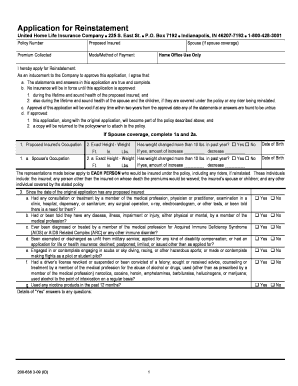

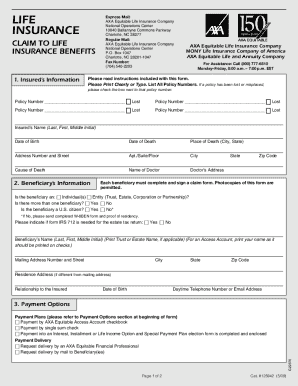

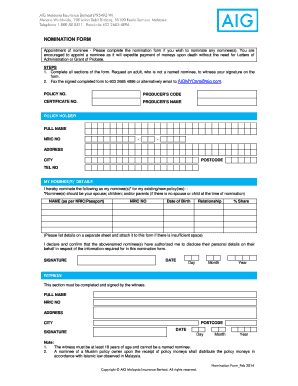

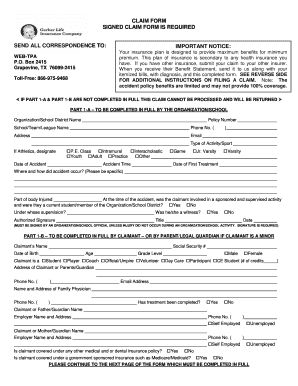

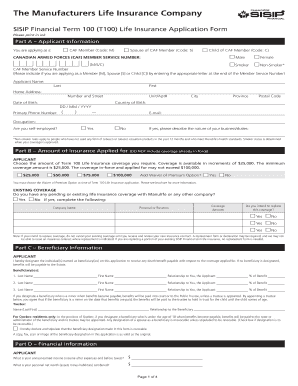

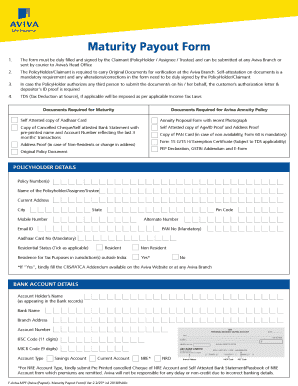

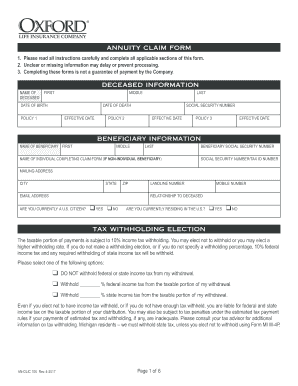

Life insurance application form pdf is a document used by individuals to apply for life insurance. It is typically a digital form that can be completed online or downloaded and filled out manually.

What are the types of Life insurance application form pdf?

There are several types of Life insurance application form pdf, including: Universal Life Insurance Application Form, Term Life Insurance Application Form, Whole Life Insurance Application Form, and Variable Life Insurance Application Form.

Universal Life Insurance Application Form

Term Life Insurance Application Form

Whole Life Insurance Application Form

Variable Life Insurance Application Form

How to complete Life insurance application form pdf

To complete a Life insurance application form pdf, follow these steps:

01

Fill in your personal information, such as name, address, and contact details

02

Provide details about your health history and lifestyle habits

03

Choose the type of life insurance coverage you want

04

Review the form for accuracy and completeness before submitting

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Life insurance application form pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is asked on a life insurance application?

The first step is to provide basic information about yourself. That includes your name, age, hometown, and Social Security number as well. Life insurance companies will also ask about marital status and number of children, which can help them understand who you are looking to protect.

How much income do I need for life insurance?

What's The Rule of Thumb for How Much Life Insurance You Need? A common rule of thumb for determining how much life insurance you need is to multiply your salary by ten. Some experts recommend multiplying it by 5 or 7.

Can I get life insurance if I have no income?

You can get life insurance if you're long-term unemployed, but it will be more difficult. The underwriter will want to understand why you're unemployed. If you haven't worked in a few years, it's more difficult to validate the need for coverage to an underwriter because they may not see a need for income protection.

How to start your own life insurance?

How to buy a life insurance policy Decide how much coverage you need. Pick a life insurance policy type. Research different life insurance carriers. Request and compare life insurance quotes. Fill out the application. Prepare for your phone interview. Schedule a life insurance medical exam. Wait for approval.

Does life insurance verify income?

Life insurance providers review various factors besides your medical history, such as your income and occupation. They may also review your net worth and other financial information.

What applicant's signature is required on a life insurance application?

Required signatures include: the applicant. the proposed insured (if different from the applicant) the agent soliciting the insurance.

Related templates