Free Donation Receipt Template Word

What is Free donation receipt template word?

A Free donation receipt template word is a customizable document that allows organizations to create professional and personalized donation receipts for donors. With this template, users can easily input the necessary information such as donor details, donation amount, date of donation, and more.

What are the types of Free donation receipt template word?

There are several types of Free donation receipt template word available, including:

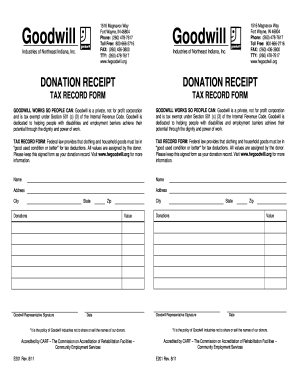

Basic donation receipt template

Detailed donation receipt template

Blank donation receipt template

Annual donation receipt template

How to complete Free donation receipt template word

Completing a Free donation receipt template word is simple and straightforward. Here are the steps to follow:

01

Download the Free donation receipt template word from a reputable source

02

Open the template in a word processing program

03

Fill in the required information such as donor details, donation amount, date, and purpose of donation

04

Customize the template to match your organization's branding if necessary

05

Save the completed receipt for record-keeping and sharing with donors

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I write a receipt for a 501c3 donation?

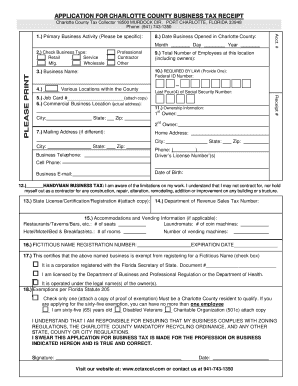

How to Write (1) Date. (2) Non-Profit Organization. (3) Mailing Address. (4) EIN. (5) Donor's Name. (6) Donor's Address. (7) Donated Amount. (8) Donation Description.

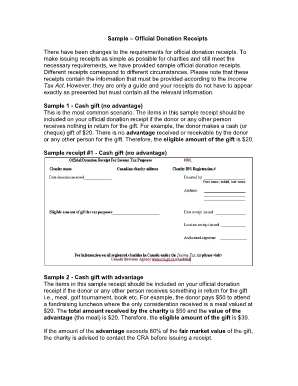

How do you write an in-kind donation receipt?

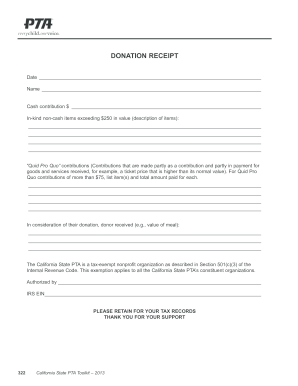

How to provide an in-kind donation receipt? In the case of in-kind donations exceeding $250, donors need to determine the deductibility of the items themselves. In that case, all you need to provide in the donation receipt is the name and EIN of the organization, date of donation, and a description of the donated item.

What is a 501c3 receipt?

A 501(c)(3) donation receipt is a written acknowledgment provided by a nonprofit organization to a donor for a tax-deductible donation. It includes specific information required by the IRS to confirm the tax-exempt status of the organization and the deductible amount of the donation.

What is a proof of donation letter?

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.

What is an example of a donation receipt?

A good example of a donation receipt text would be: “Thank you for your cash contribution of $300 that (organization's name) received on December 12, 2015. No goods or services were provided in exchange for your contribution.” It's wise to create donation receipt templates as it simplifies the procedure.

How do I make a donation receipt?

You should always have the following information on your donation receipts: Name of the organization. Donor's name. Recorded date of the donation. Amount of cash contribution or fair market value of in-kind goods and services. Organization's 501(c)(3) status.