Credit Check Form For Business

What is Credit check form for business?

A Credit check form for business is a document used to assess the financial credibility of a company or individual applying for credit. It helps lenders determine the risk level associated with providing credit to the applicant.

What are the types of Credit check form for business?

There are several types of Credit check forms for businesses, including:

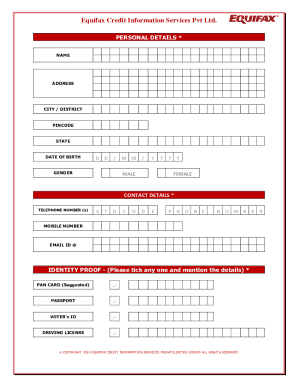

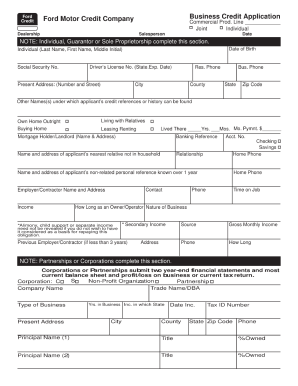

Personal Credit Check Form - used to assess the creditworthiness of an individual applying for business credit.

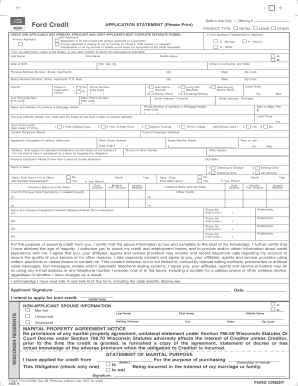

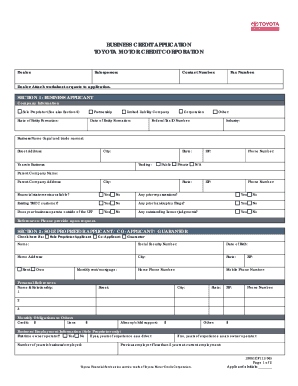

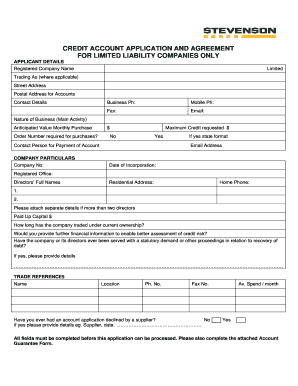

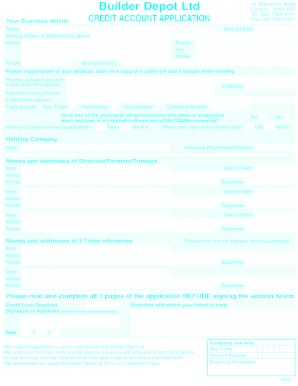

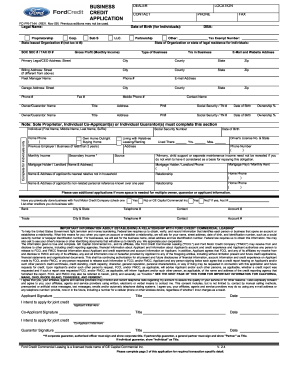

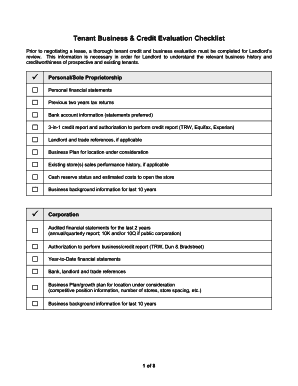

Business Credit Check Form - used to evaluate the credit history and financial standing of a company applying for credit.

Vendor Credit Check Form - used by businesses to assess the creditworthiness of vendors before entering into agreements.

How to complete Credit check form for business

Completing a Credit check form for business is a simple process that involves the following steps:

01

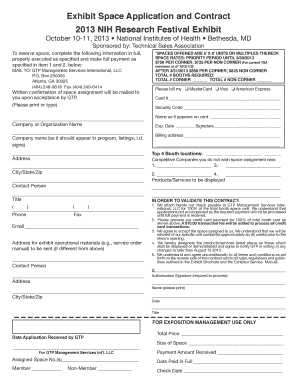

Fill in your personal or business information accurately.

02

Provide details about your financial history, including income, assets, and debts.

03

Submit any required supporting documents, such as tax returns or bank statements.

04

Review the form for accuracy and completeness before submitting it to the lender.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Credit check form for business

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

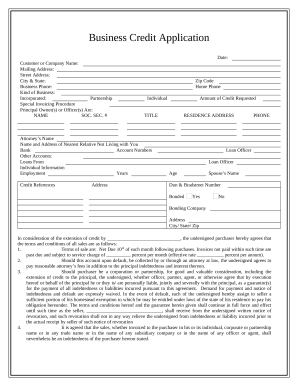

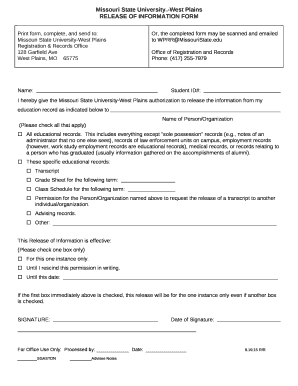

How to create a business credit application form?

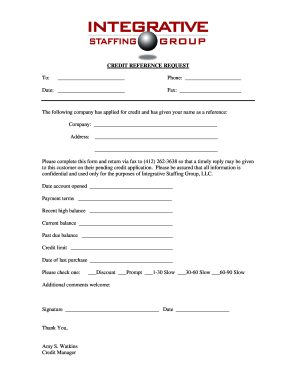

WHAT TO INCLUDE IN A BUSINESS CREDIT APPLICATION Name of the business, address, phone and fax number. Names, addresses, Social Security numbers of principals. Type of business (corporation, partnership, proprietorship) Industry. Number of employees. Bank references. Trade payment references.

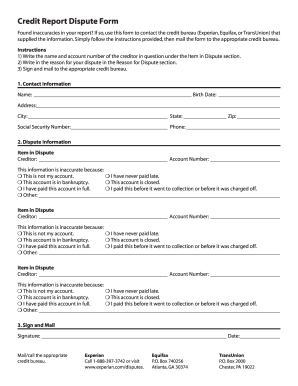

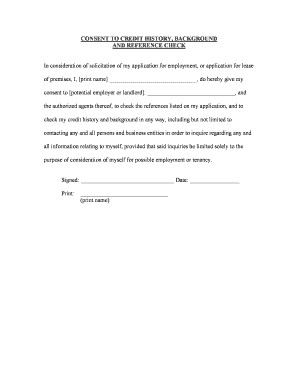

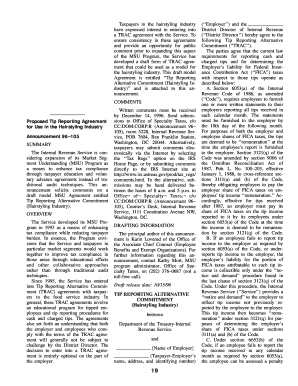

What is the FCRA consent for credit report?

A consumer reporting agency may provide information about you only to people with a valid need -- usually to consider an application with a creditor, insurer, employer, landlord, or other business. The FCRA specifies those with a valid need for access. You must give your consent for reports to be provided to employers.

How do I get a credit consent form?

Getting Consent to Run a Credit Report Step 1 – Explain the Purpose to the Individual. Step 2 – Completing the Form. Step 3 – Obtaining a Real Signature. Step 4 – Run the Credit Report. Step 5 – Review and Give a Copy to the Consenter (if asked)

What is FCRA release form?

A compliant FCRA authorization form is an acknowledgement that a pre-employment background check will be conducted. It can be presented as a self-contained document or jointly with an FCRA disclosure form.

What is a credit check form?

A credit report authorization form is a written document that a person can provide to an individual or organization to review their credit report. This permission does not apply to access all accounts or financial information about a person but only shows a report on loans (debts and their payments).

How do businesses do credit checks?

You'll also need to get their consent to obtain a credit report. Once you have an employee's information and consent, relay their information to a credit bureau or background check service that will generate a report for your review. Many services can help you conduct employee background and credit checks.