Credit Check Form For Tenants

What is Credit check form for tenants?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Fusce euismod lacus ut turpis gravida, nec suscipit ligula vestibulum. Morbi imperdiet turpis eget mi pharetra, vitae tincidunt ligula lacinia.

What are the types of Credit check form for tenants?

There are several types of Credit check forms for tenants, including:

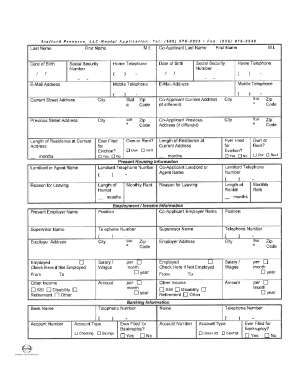

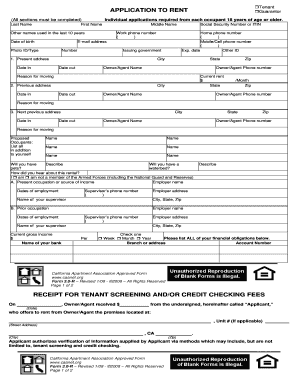

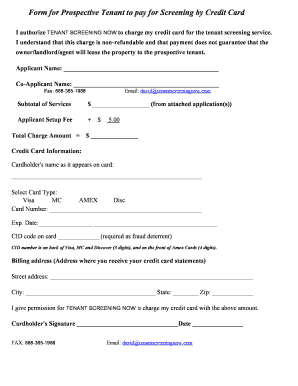

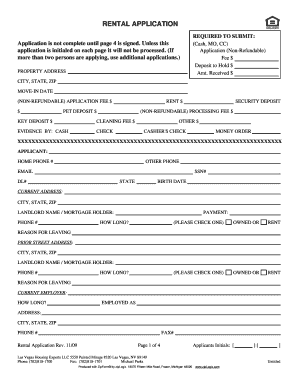

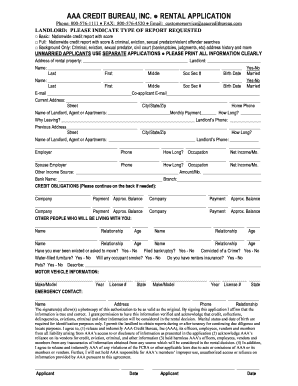

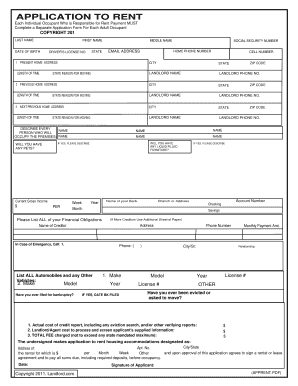

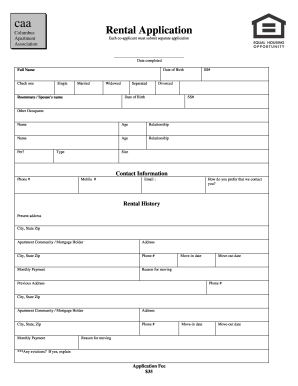

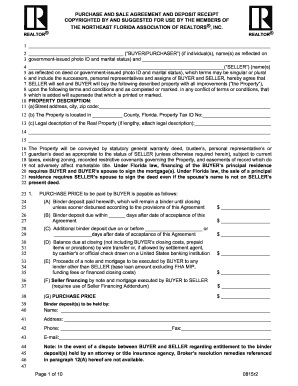

Basic Credit Check Form

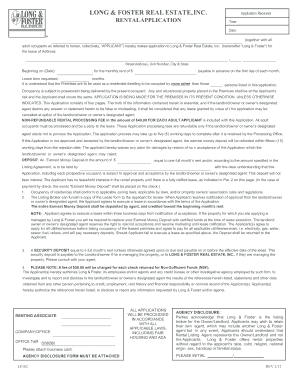

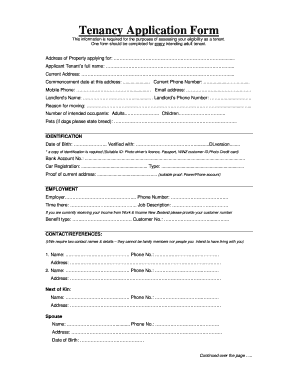

Comprehensive Credit Check Form

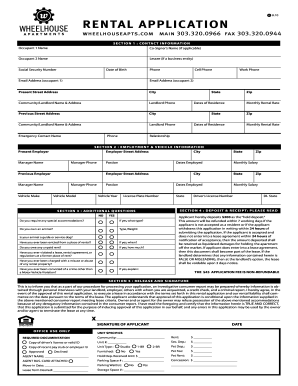

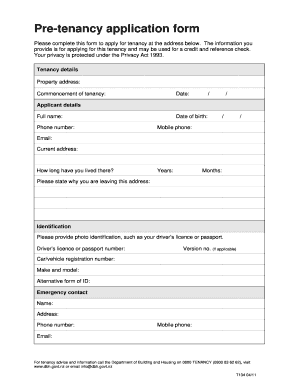

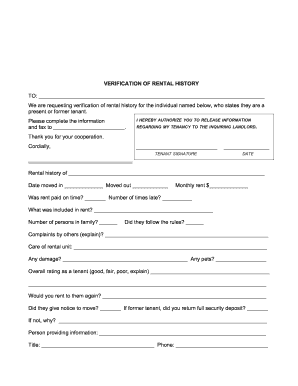

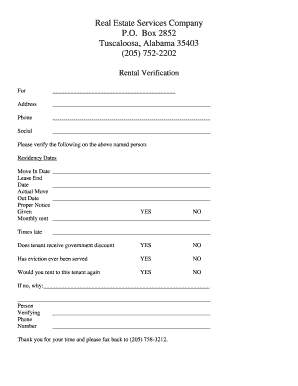

Rental History Check Form

How to complete Credit check form for tenants

Completing a Credit check form for tenants is a simple process that can be broken down into the following steps:

01

Fill in personal information such as name, address, and contact details.

02

Provide employment information including current job, income, and employer contact information.

03

Include references from previous landlords or personal references.

04

Sign and date the form to validate the information provided.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Credit check form for tenants

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Why does credit matter when renting an apartment?

Most landlords use a combination of credit checks and background checks to determine a potential tenant's ability to pay rent consistently on time. While these measures don't tell a person's whole financial story, these are the most commonly used tools to assess liability and protect the landlord.

What is credit check consent form?

A credit report authorization form is a document used to give permission to an individual or organization to perform a credit report only. This form provides broad language that allows a credit report to be generated for any type of legal reason in compliance with the Fair Credit Reporting Act (FCRA) (15 U.S.C.

How do I run a credit check on a tenant in California?

Once a prospective tenant completes a rental application, you'll need to: Verify the tenant's full name, employment history and residential address. Get the tenant's written permission to run a credit check. Choose a credit reporting agency to work with. Confirm you're the landlord of the rental property.

Is it normal for renters to ask for credit score?

There are many reasons why someone would ask for your credit history. For instance, when you apply for a new credit card or take out a mortgage or even rent an apartment! Lenders and landlords carry out credit inquiries to determine whether you are likely to be a financial risk.

Why do renters check credit?

Ultimately, a credit report gives landlords a holistic view of their prospective tenant's financial history and can help you determine if you're going to run into nonpayment issues down the line.

Why do landlords care about credit score?

Instead, the landlord might concentrate more on the potential renter's overall credit history, particularly their record of on-time payments. A landlord is trying to assess the likelihood that you'll pay your rent on time every month, and reviewing your track record of managing your debts can help them with that.