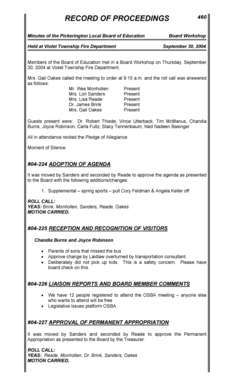

Balancing Your Checking Account Worksheet Answers

What is balancing your checking account worksheet answers?

Balancing your checking account worksheet answers refers to the process of reconciling the transactions and balances in your checking account to ensure that they match with your bank's records. It helps you track your expenses, identify any errors or discrepancies, and maintain an accurate record of your finances.

What are the types of balancing your checking account worksheet answers?

There are different types of balancing your checking account worksheet answers, including:

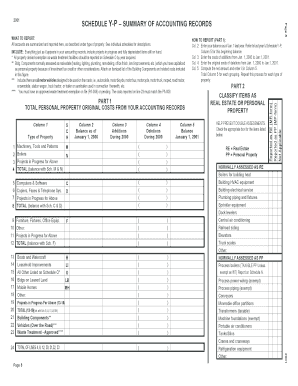

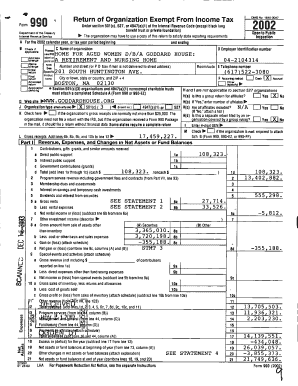

Manual Balancing: This involves manually recording your transactions and comparing them with your bank statements.

Online Banking: Many banks provide online platforms or apps where you can view and reconcile your account transactions.

Spreadsheet Templates: Some individuals create their own customized spreadsheet templates to track their transactions and balance their checking accounts.

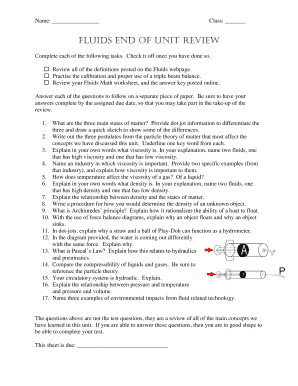

How to complete balancing your checking account worksheet answers

Completing balancing your checking account worksheet answers can be done in a few simple steps:

01

Gather your bank statements and any supporting documents, such as receipts or invoices.

02

Compare each transaction on your bank statement with the corresponding entry in your checking account worksheet.

03

Identify any discrepancies or errors and make the necessary corrections.

04

Adjust your checking account worksheet balance to match the closing balance on your bank statement.

05

Reconcile any outstanding deposits or withdrawals to ensure they are accurately reflected in both your worksheet and bank statement.

06

Double-check your calculations and ensure all entries are accurate.

07

Keep a record of your completed balancing your checking account worksheet for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out balancing your checking account worksheet answers

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Why can't I balance my checkbook?

Even if you record all of your checking account charges, withdrawals, checks, and deposits in your checkbook, your balance may not match the amount on your bank statement. This could be due to transactions that haven't yet registered at your bank—or it could be an error that you or the bank made.

What does it mean to balance a checking account?

The process of balancing your account simply involves listing your debits and credits (deposits and withdrawals), and adding them up to determine your balance. It can be done using pen and paper or money management software.

How do you write a check and balance a checkbook?

Check out our quick how-to. Step 1: Date the check. Write the date on the line at the top right-hand corner. Step 2: Who is this check for? Step 3: Write the payment amount in numbers. Step 4: Write the payment amount in words. Step 5: Write a memo. Step 6: Sign the check.

What is it called when you balance your checking account?

Balancing your checkbook, which is also known as reconciling your account, is basically about making sure that the records you have kept for your financial transactions match those the bank lists on your statement.

What are the steps to balancing your checking account?

How to Balance a Checkbook in 5 Steps Step 1: Write Down Your Transactions Often. Step 2: Open Your Checking Account Statement. Step 3: Check All Transactions. Step 4: Update Your Balance. Step 5: Repeat.

Do you really need to balance your checkbook?

Why Balance Your Checkbook? Even today, when much (if not all) of your transaction information is available with the click of a button, it's still a good idea to maintain a record of your transactions and regularly balance that record.

Related templates