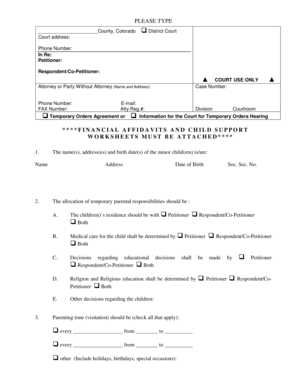

Checking Account Reconciliation Worksheet

What is checking account reconciliation worksheet?

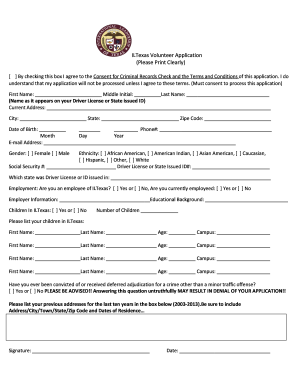

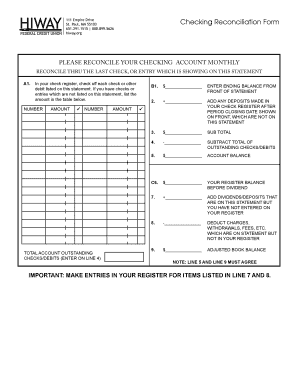

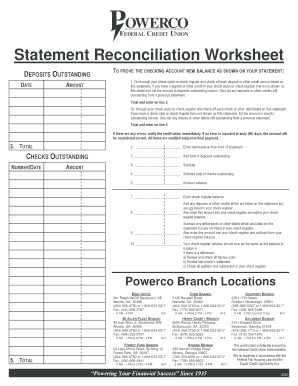

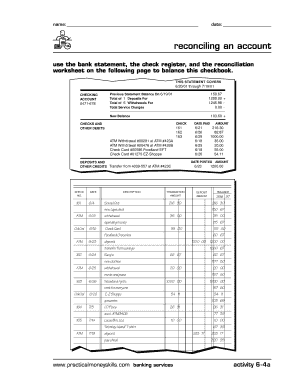

A checking account reconciliation worksheet is a tool that helps individuals or businesses track and compare their bank statement with their own records. It allows you to identify any discrepancies or errors in your account transactions and ensure that your records match those of the bank. By using a checking account reconciliation worksheet, you can ensure the accuracy of your financial records and detect any fraudulent activities.

What are the types of checking account reconciliation worksheet?

There are two main types of checking account reconciliation worksheet: manual and electronic. Both types serve the same purpose, but the methods of recording and reconciling transactions differ. Manual reconciliation involves manually recording and comparing transactions on a paper or spreadsheet, while electronic reconciliation utilizes software or online tools to automate the process. Each type has its own advantages and disadvantages, so it's important to choose the one that best fits your needs and preferences.

How to complete checking account reconciliation worksheet

Completing a checking account reconciliation worksheet is a straightforward process that involves the following steps:

By following these steps, you can effectively complete a checking account reconciliation worksheet and maintain accurate financial records.