Credit Card Expense Report Template

What is Credit Card Expense Report Template?

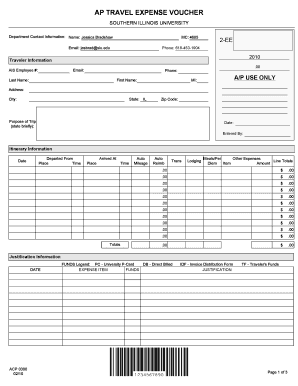

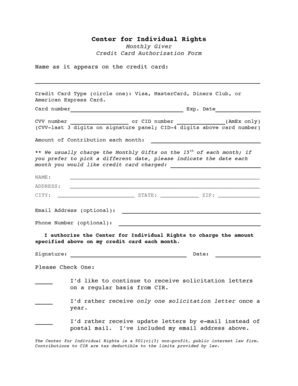

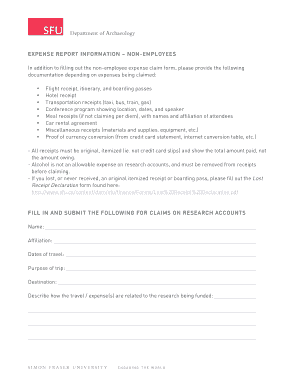

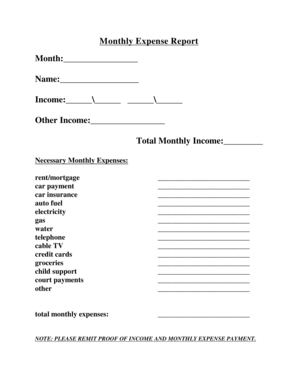

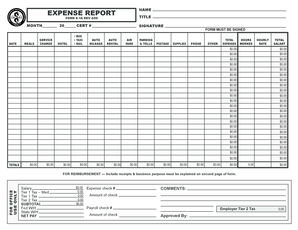

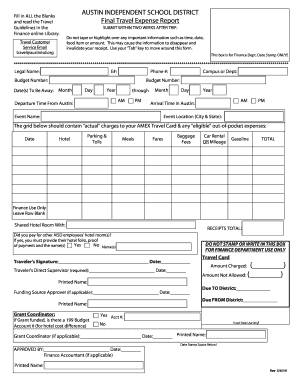

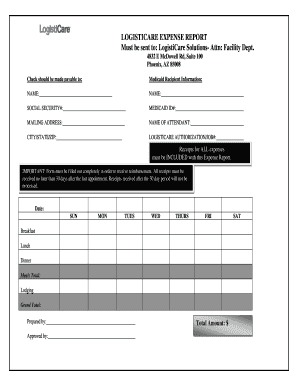

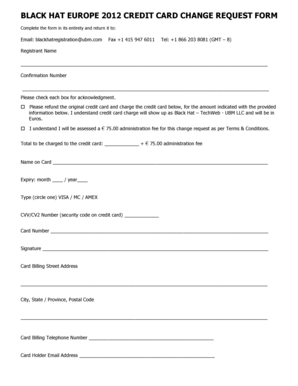

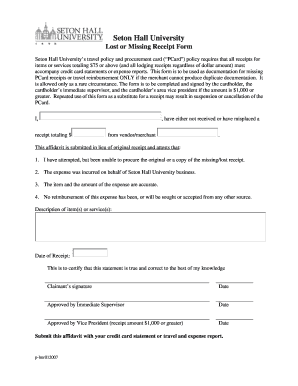

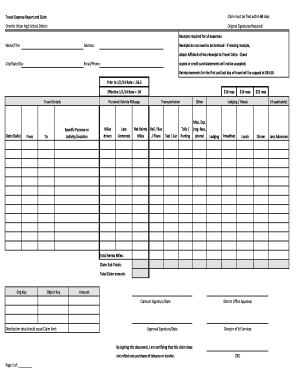

A Credit Card Expense Report Template is a pre-designed document that allows users to track and organize their credit card expenses. It provides a structured format for recording information such as the date of purchase, merchant name, payment method, and amount. With this template, users can easily analyze their spending patterns, identify trends, and manage their finances more effectively.

What are the types of Credit Card Expense Report Template?

Credit Card Expense Report Templates come in various formats and layouts to cater to different needs. Some common types include:

How to complete Credit Card Expense Report Template

Completing a Credit Card Expense Report Template is simple and straightforward. Follow these steps:

By using pdfFiller, you can easily create, edit, and share your Credit Card Expense Report Template online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that streamlines the document creation process. Take advantage of its features to efficiently manage your credit card expenses and achieve better financial management.