Financial Calculator Excel - Page 2

What is Financial Calculator Excel?

Financial Calculator Excel is a tool that allows users to perform various financial calculations using Microsoft Excel. It provides a convenient way to calculate loan payments, interest rates, investment returns, and other financial metrics. With Financial Calculator Excel, users can easily analyze their financial data and make informed decisions.

What are the types of Financial Calculator Excel?

Financial Calculator Excel comes in different types, each catering to specific financial calculations. Some common types include:

Loan calculators

Investment calculators

Mortgage calculators

Retirement calculators

Savings calculators

How to complete Financial Calculator Excel

To complete Financial Calculator Excel, follow these steps:

01

Open Microsoft Excel and create a new worksheet.

02

Identify the type of financial calculation you need to perform.

03

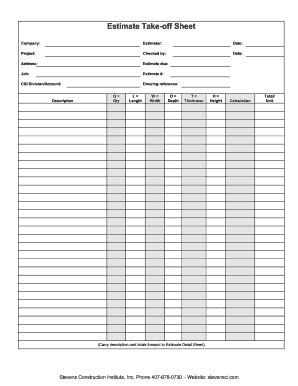

Search for a suitable Financial Calculator Excel template online.

04

Download and open the template in Microsoft Excel.

05

Enter your financial data into the designated cells of the template.

06

Follow any instructions or guidelines provided with the template.

07

Review the calculated results and make any necessary adjustments.

08

Save and share the completed Financial Calculator Excel workbook.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I use Excel to calculate finance?

Excel for Finance #1 XNPV. Formula: =XNPV(discount_rate, cash_flows, dates) #2 XIRR. Formula: =XIRR(cash flows, dates) #3 MIRR. Formula: =MIRR(cash flows, cost of borrowing, reinvestment rate) #4 PMT. Formula: =PMT(rate, number of periods, present value) #5 IPMT. #6 EFFECT. #7 DB. #8 RATE.

How do you calculate finance on a calculator?

3:51 5:43 Financial Calculator Part 2 - Basic PV and FV - YouTube YouTube Start of suggested clip End of suggested clip This will be over a 10-year time frame. So I take 10 and I put that into my N. And we're stillMoreThis will be over a 10-year time frame. So I take 10 and I put that into my N. And we're still having making no there are no interim payments in between so payments are still 0.

How do I make a calculator on my spreadsheet?

Here's how: Type the equal symbol (=) in a cell. This tells Excel that you are entering a formula, not just numbers. Type the equation you want to calculate. For example, to add up 5 and 7, you type =5+7. Press the Enter key to complete your calculation. Done!

How do you get Excel to add Money?

Select a cell next to the numbers you want to sum, click AutoSum on the Home tab, press Enter, and you're done. When you click AutoSum, Excel automatically enters a formula (that uses the SUM function) to sum the numbers. Here's an example.

How do I use the money template in Excel?

Set up financial accounts in Money in Excel Once you open the Money in Excel template, the Money in Excel pane will open on the right. In the Money in Excel pane, select Get started. Once signed in with your Microsoft 365 subscription, Money in Excel will ask you to link your financial accounts.

How do I use a budget template in Excel?

How to Create a Budget Spreadsheet in Excel Identify Your Financial Goals. Determine the Period Your Budget Will Cover. Calculate Your Total Income. Begin Creating Your Excel Budget. Enter All Cash, Debit and Check Transactions into the Budget Spreadsheet. Enter All Credit Transactions.

Related templates