What is Financial Statement Form?

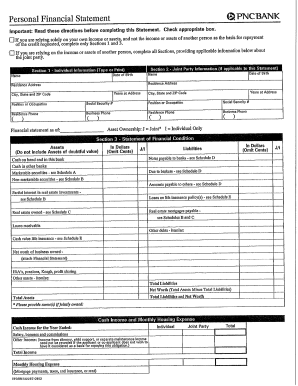

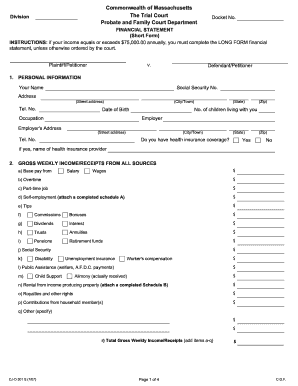

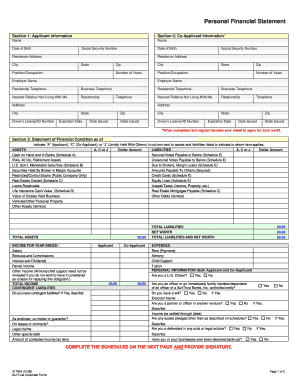

A Financial Statement Form is a document that provides an overview of a company's financial status. It includes information about the company's assets, liabilities, and equity. This form is typically used by businesses to assess their financial performance and make informed decisions.

What are the types of Financial Statement Form?

There are several types of Financial Statement Forms, each serving a different purpose. The most common types include:

Balance Sheet: This form shows a company's assets, liabilities, and equity at a specific point in time.

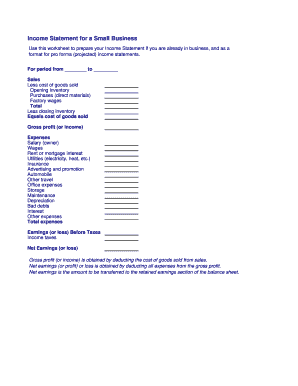

Income Statement: Also known as the Profit and Loss Statement, this form summarizes a company's revenues, expenses, and net income or loss over a particular period.

Cash Flow Statement: This form tracks the flow of cash in and out of a company, providing insights into its liquidity and operating activities.

Statement of Retained Earnings: This form shows the changes in a company's retained earnings over a specific period.

Statement of Changes in Equity: This form outlines the changes in a company's equity accounts during a given period.

How to complete Financial Statement Form

Completing a Financial Statement Form may seem intimidating, but with the right approach, it can be straightforward. Here's a step-by-step guide to help you:

01

Gather all necessary financial documents, such as bank statements, invoices, and expense records.

02

Organize the information into relevant categories, such as assets, liabilities, and expenses.

03

Fill in the values accurately for each category. Double-check for any errors or inconsistencies.

04

Calculate the totals for each category and transfer the amounts to the appropriate sections of the form.

05

Review the completed form to ensure accuracy and completeness.

06

Save the form and keep a copy for your records.

In order to simplify the process of creating and completing Financial Statement Forms, pdfFiller offers a user-friendly and efficient solution. With unlimited fillable templates and powerful editing tools, pdfFiller empowers users to create, edit, and share their financial statements securely online. By using pdfFiller, you can streamline your document workflow and focus on making informed financial decisions.