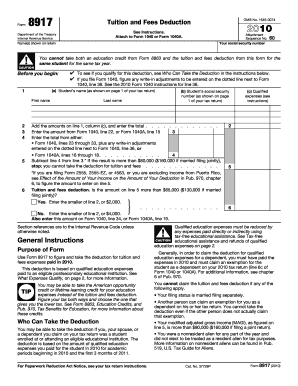

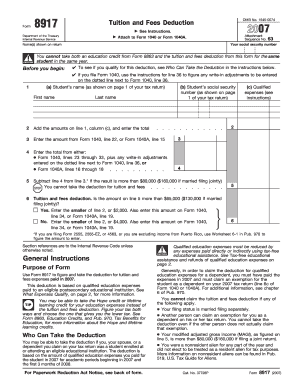

Form 8917

What is form 8917?

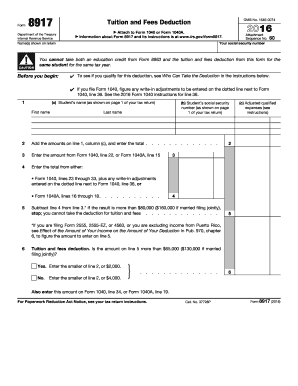

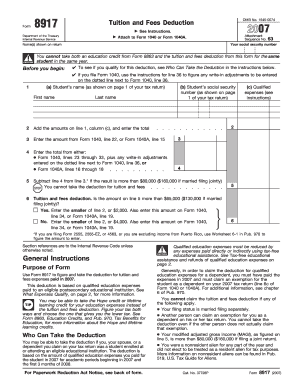

Form 8917 is an IRS tax form used by individuals to claim the tuition and fees deduction. This deduction allows eligible students to lower their taxable income by deducting qualified education expenses.

What are the types of form 8917?

There is only one type of form 8917, which is used to claim the tuition and fees deduction.

Tuition and fees deduction

How to complete form 8917

Completing form 8917 is a straightforward process. Here are the steps:

01

Gather your documents: Collect all the necessary documents, such as your Form 1098-T from your educational institution.

02

Fill in the required information: Provide your personal details, including your name, Social Security number, and address.

03

Enter your education expenses: Report the amount of qualified education expenses you paid during the tax year.

04

Calculate your deduction: Follow the instructions to calculate the amount of your tuition and fees deduction.

05

File your form: Once you have completed all the fields accurately, sign and date the form before submitting it.

06

Please note that it is always a good idea to double-check your entries and consult a tax professional if needed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out form 8917

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a 8917 tax form?

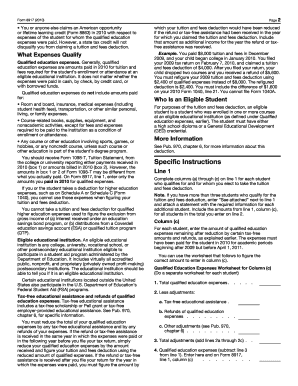

Use Form 8917 (Rev. January 2020) to figure and take the deduction for tuition and fees expenses paid in calendar years 2018, 2019, and 2020, and later years if the deduction is extended. This deduction is based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary).

Who can file form 8917?

Who Can Use Form 8917? According to IRS rules, you may be eligible to use Form 8917 if you, your spouse or a dependent claimed on your tax return was enrolled in a qualified educational institution in the relevant tax year. “Qualified” means the institution must be an institute of higher learning.

How do you qualify for the American Opportunity credit?

To be eligible for AOTC, the student must: Be pursuing a degree or other recognized education credential. Be enrolled at least half time for at least one academic period* beginning in the tax year. Not have finished the first four years of higher education at the beginning of the tax year.

How do I qualify for tuition and fees deduction?

Qualifying expenses include what you pay in tuition and mandatory enrollment fees to attend any accredited public or private institution above the high school level. You cannot take a deduction for: Room and board, optional fees (such as for student health insurance), transportation, or other similar personal expenses.

Who qualifies for tuition and fees deduction?

The taxpayer, spouse or dependent has received or will receive a Form 1098-T from an eligible domestic or foreign education institution. If the college isn't required to send Form 1098-T, the taxpayer must be able to demonstrate they were enrolled at the college and paid for qualified expenses.

What is Schedule D Form 1040?

Use Schedule D (Form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit.

Related templates