Hardship Letter For Loan Modification Template

What is Hardship Letter For Loan Modification Template?

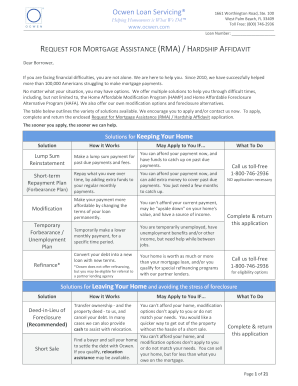

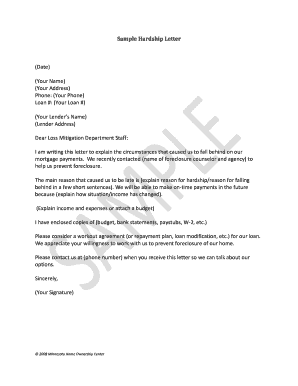

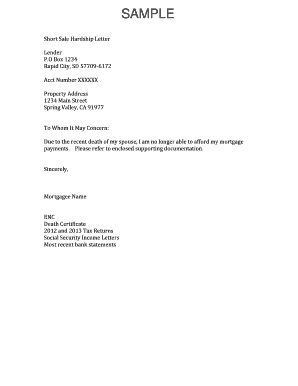

A hardship letter for loan modification template is a document that borrowers use to explain their financial difficulties to their lenders. It is an essential part of the loan modification process and provides a detailed account of the borrower's circumstances, including the reasons behind their financial hardship.

What are the types of Hardship Letter For Loan Modification Template?

There are several types of hardship letter for loan modification templates available depending on the specific situation of the borrower. Some common types include: 1. Medical hardship: This type of letter explains the borrower's medical condition and how it has impacted their financial situation. 2. Unemployment hardship: This template is used by individuals who have lost their jobs and are facing financial difficulties as a result. 3. Financial hardship due to divorce: This template is for borrowers who are experiencing financial hardships due to a divorce or separation. 4. Natural disaster hardship: Borrowers affected by natural disasters can use this template to explain the financial impact of the event.

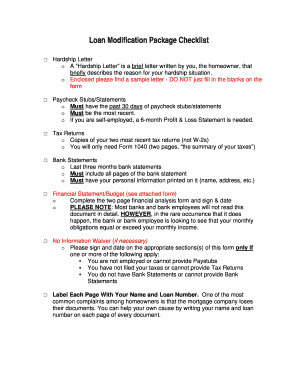

How to complete Hardship Letter For Loan Modification Template

Completing a hardship letter for loan modification template requires careful attention to detail and a clear explanation of the borrower's financial situation. Here are some steps to follow: 1. Open the template provided by the lender or use a standard format. 2. Begin by addressing the letter to the lender or loan servicer. 3. Provide a brief introduction and explain the purpose of the letter. 4. Describe the borrower's financial difficulties and the reasons behind them. 5. Include any supporting documents, such as medical bills or termination letters. 6. Express the borrower's willingness to cooperate and work towards a solution. 7. Thank the lender for their understanding and consideration.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.