How To Calculate Net Worth Of A Company

What is how to calculate net worth of a company?

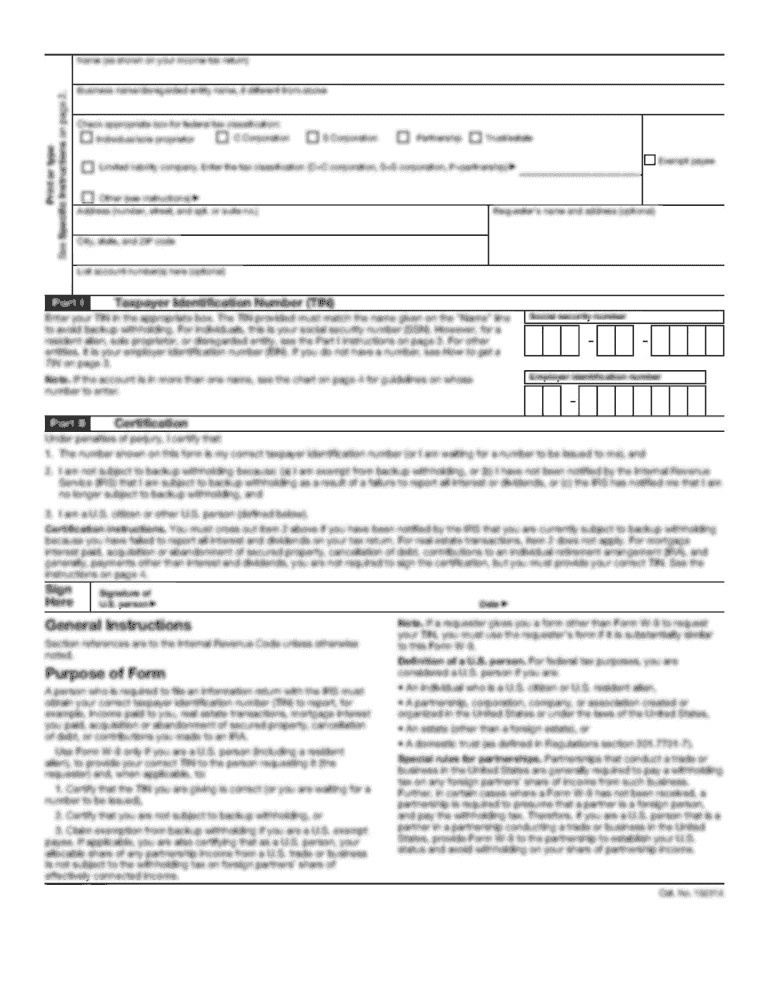

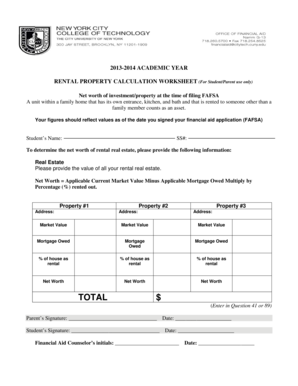

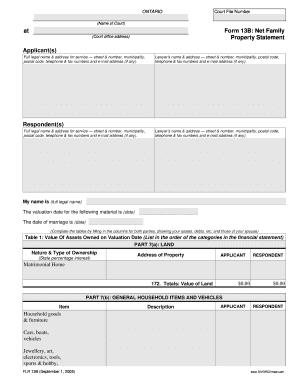

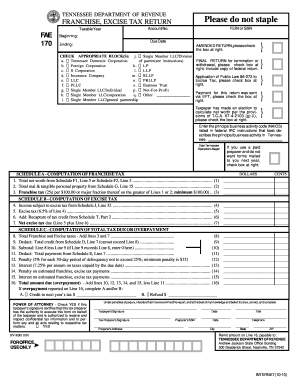

To calculate the net worth of a company, you need to subtract its total liabilities from its total assets. Net worth, also known as shareholder's equity or book value, represents the value of a company after all its debts are paid off. It is an important metric that investors and analysts use to assess the financial health and stability of a company.

What are the types of how to calculate net worth of a company?

There are two main types of calculating net worth: the balance sheet method and the income statement method. 1. Balance Sheet Method: This method involves determining the net worth of a company by subtracting its total liabilities from its total assets, as mentioned earlier. It provides a snapshot of the company's financial position at a specific point in time. 2. Income Statement Method: This method calculates net worth by subtracting the cumulative total of a company's expenses and losses from its cumulative total of revenues and gains over a specific period of time. It provides a more dynamic perspective on the company's financial performance.

How to complete how to calculate net worth of a company

To complete the process of calculating the net worth of a company, follow these steps: 1. Obtain the company's balance sheet and income statement. 2. Identify the total assets listed on the balance sheet. 3. Identify the total liabilities listed on the balance sheet. 4. Subtract the total liabilities from the total assets to calculate the company's net worth using the balance sheet method. 5. Alternatively, if using the income statement method, determine the cumulative total of revenues and gains, as well as the cumulative total of expenses and losses over the desired period of time. 6. Subtract the cumulative total of expenses and losses from the cumulative total of revenues and gains to calculate the net worth of the company using the income statement method. Remember, accurate and up-to-date financial statements are crucial for an accurate calculation of net worth.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.