What is Sample Proof Of Income Letter?

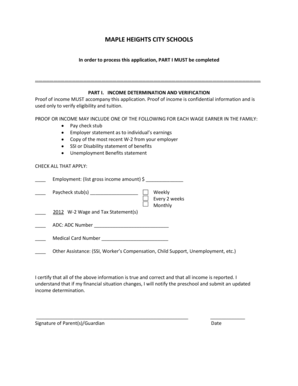

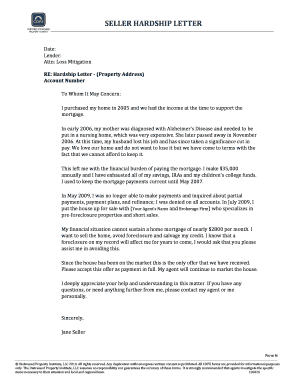

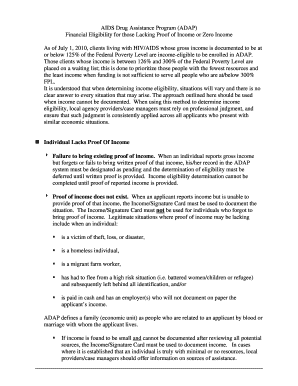

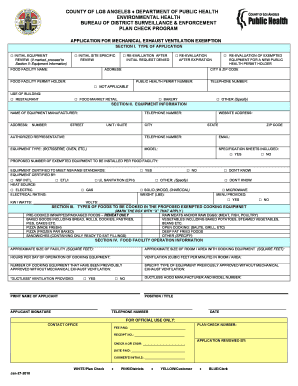

A Sample Proof Of Income Letter is a document that confirms an individual's income. It is often required by various entities such as landlords, lenders, or government agencies to verify a person's financial stability and eligibility for certain benefits or services. The letter typically includes details about the person's employment status, salary or wages, and length of employment.

What are the types of Sample Proof Of Income Letter?

There are several types of Sample Proof Of Income Letters that can be used depending on the specific situation. These may include:

Employment Verification Letter: This letter is issued by an employer to confirm an employee's income and employment status.

Pay Stub: A pay stub provides a detailed breakdown of an individual's earnings, deductions, and taxes withheld for a specific pay period.

Tax Returns: The income reported on tax returns can serve as proof of income.

Bank Statements: Bank statements can be used to show regular deposits or income streams.

Social Security Benefit Letter: Individuals receiving Social Security benefits can use the benefit letter as proof of income.

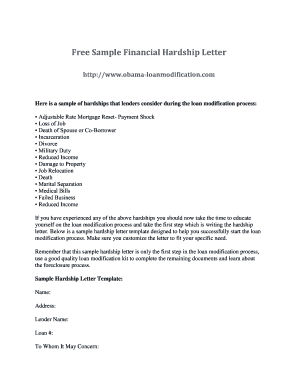

How to complete Sample Proof Of Income Letter

Completing a Sample Proof Of Income Letter involves a few important steps:

01

Start by addressing the letter to the appropriate recipient or organization.

02

Include your personal information, such as your name, address, and contact details.

03

State the purpose of the letter and why you are providing proof of income.

04

Provide detailed information about your income, including your employment status, salary or wages, and any additional sources of income.

05

If necessary, attach supporting documents such as pay stubs, tax returns, or bank statements.

06

End the letter with a formal closing and your signature.

07

Make a copy of the letter for your records before submitting it.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.