Income Verification Letter For Independent Contractor

What is income verification letter for independent contractor?

An income verification letter for independent contractor is a document that confirms a self-employed individual's income. It is often requested by lenders, landlords, or government agencies as proof of income for various purposes, such as securing a loan, renting an apartment, or qualifying for government assistance programs. The letter typically includes information about the contractor's name, address, contact details, and a statement of their income for a specific period.

What are the types of income verification letter for independent contractor?

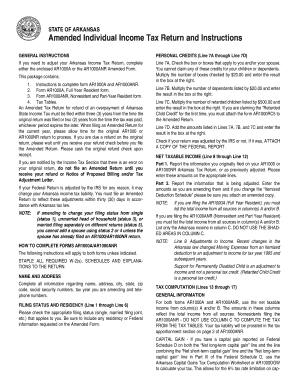

There are several types of income verification letters for independent contractors, depending on the specific requirements of the requesting party. Some common types include: 1. Self-employment income verification letter: This letter confirms the contractor's income from their self-employed business. 2. Tax return income verification letter: This letter is based on the contractor's filed tax returns and provides a comprehensive overview of their income. 3. Client income verification letter: This letter is provided by a client or multiple clients to confirm the income earned by the contractor for a particular project or period. 4. Bank statement income verification letter: This letter includes information from the contractor's bank statements, detailing their income deposits and financial transactions.

How to complete income verification letter for independent contractor

Completing an income verification letter for an independent contractor can be done by following these steps: 1. Begin by addressing the letter to the appropriate recipient, mentioning their name and contact details. 2. Introduce yourself as an independent contractor and provide your full name, address, and contact information. 3. State the purpose of the letter and why the recipient requires income verification. 4. Clearly mention the time period for which the income verification is being provided. 5. Provide a detailed breakdown of your income, including all sources and amounts. 6. If required, attach supporting documents such as tax returns, bank statements, or client contracts. 7. Sign the letter and include your contact information for any further queries. Remember, accuracy and honesty are crucial when completing an income verification letter to maintain credibility and ensure the letter serves its intended purpose.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.