What is proof of income letter from accountant?

A proof of income letter from an accountant is a document that verifies an individual's income. This letter is usually written and signed by a certified public accountant (CPA) to provide evidence of the income stated by the individual. It is commonly used for various purposes such as obtaining loans, renting properties, applying for government benefits, or demonstrating financial stability.

What are the types of proof of income letter from accountant?

There are several types of proof of income letters that an accountant can provide, depending on the specific requirements of the requesting party. Some common types include:

Employment Verification Letter: This letter confirms the individual's employment status, position, and income earned from their job.

Self-Employment Verification Letter: This letter is for individuals who are self-employed or have their own business. It verifies their income and business details.

Social Security Income Verification Letter: This letter provides proof of income received from social security benefits, including retirement, disability, or survivor benefits.

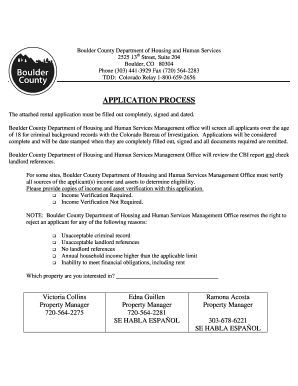

Rental Income Verification Letter: This letter is for landlords or property managers verifying the rental income earned by an individual.

Bank Account Verification Letter: This letter confirms the individual's income based on their bank account transactions and balances.

How to complete proof of income letter from accountant

To complete a proof of income letter from an accountant, follow these steps:

01

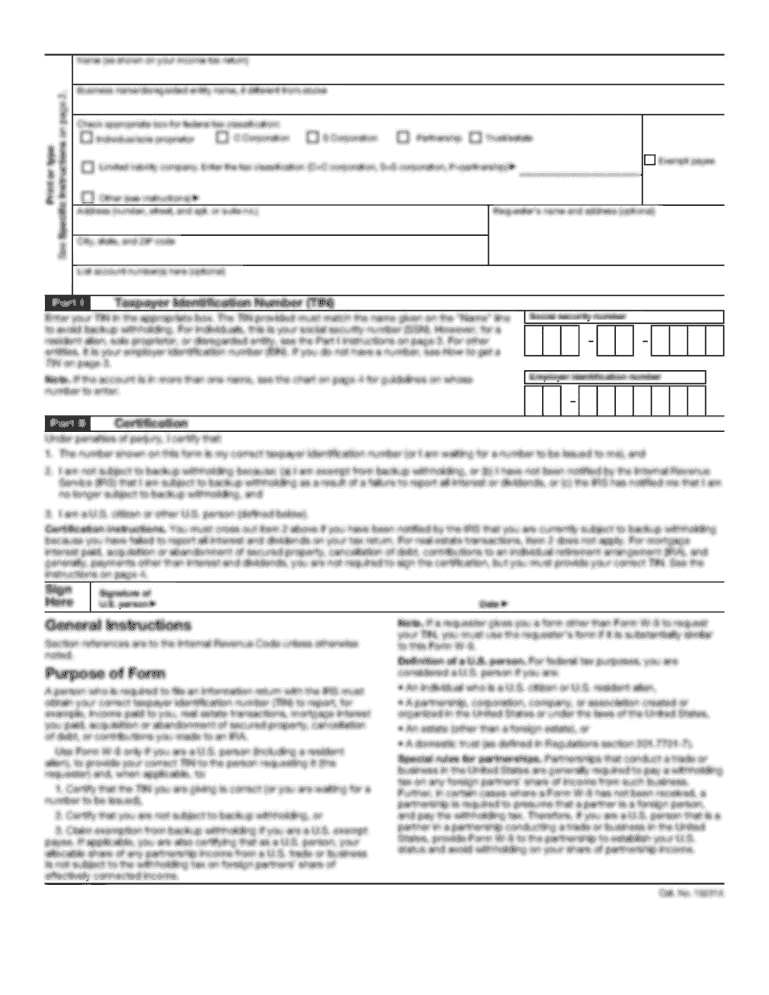

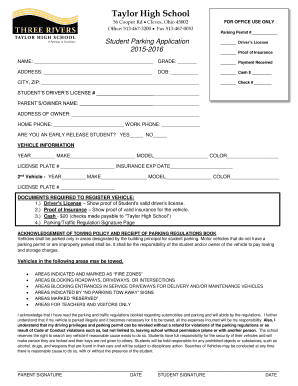

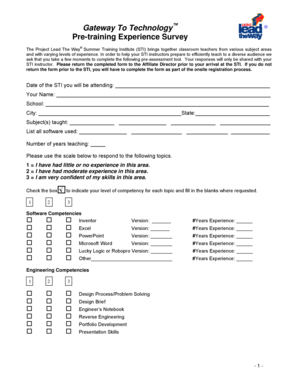

Gather necessary information: Provide the accountant with your personal details and any specific requirements from the requesting party.

02

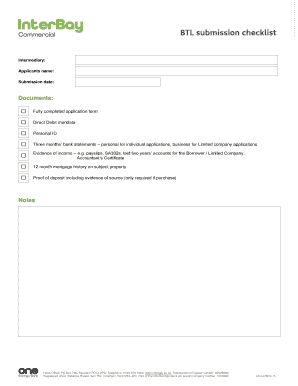

Provide supporting documents: If required, gather and submit relevant documents such as pay stubs, bank statements, tax returns, or financial statements.

03

Engage with your accountant: Schedule a meeting or communicate with your accountant to discuss your income details and any additional requirements.

04

Review and sign the letter: Once the accountant prepares the letter, review it for accuracy and completeness. Sign the letter to confirm its authenticity.

05

Make copies and distribute: Make copies of the signed letter for your records and distribute the original to the requesting party.

pdfFiller is an excellent tool that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to efficiently complete your proof of income letter and other important documents.