Personal Loan Agreement Letter

What is personal loan agreement letter?

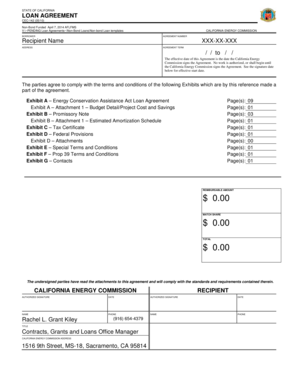

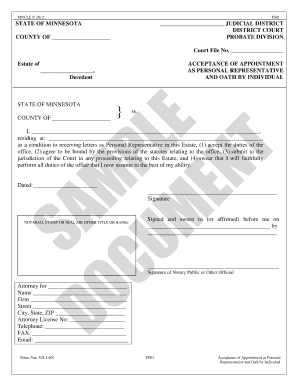

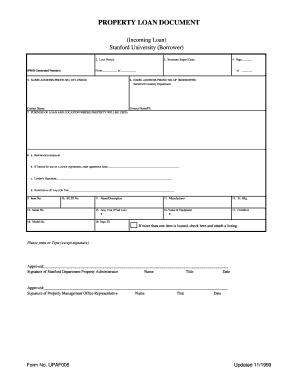

A personal loan agreement letter is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It serves as a written confirmation of the agreement reached between both parties regarding the loan amount, repayment terms, interest rate, and any other relevant details. This letter is important as it helps to ensure transparency and clarity in the loan transaction.

What are the types of personal loan agreement letter?

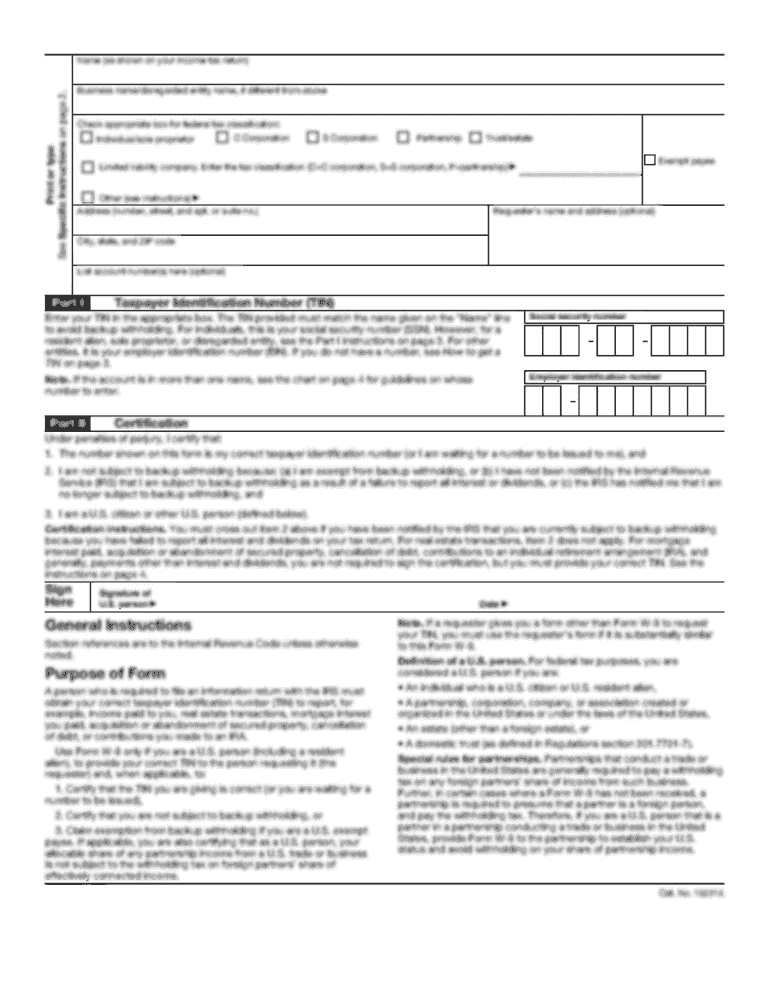

There are several types of personal loan agreement letters that can be used depending on the nature of the loan and the parties involved. Some common types include: 1. Installment Loan Agreement: This type of agreement is used when the loan amount is to be repaid in fixed monthly installments. 2. Balloon Loan Agreement: In this type of agreement, the borrower agrees to make smaller monthly payments followed by a larger payment at the end of the loan term. 3. Secured Loan Agreement: This agreement includes collateral provided by the borrower to secure the loan, reducing the risk for the lender. 4. Unsecured Loan Agreement: Unlike a secured loan, this agreement does not require any collateral and relies solely on the borrower's creditworthiness. 5. Promissory Note: Although not a traditional letter, a promissory note serves as a legally binding document that includes the borrower's promise to repay the loan.

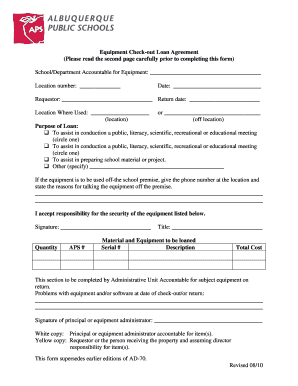

How to complete personal loan agreement letter

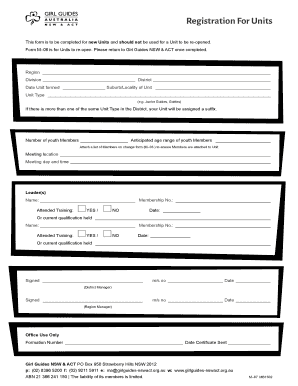

Completing a personal loan agreement letter may seem daunting, but with the right approach, it can be done efficiently. Here are some steps to follow: 1. Gather necessary information: Collect all the required details about the loan, including the loan amount, interest rate, repayment schedule, and any additional terms. 2. Use a template: Consider using a fillable template, like the ones provided by pdfFiller, to streamline the process and ensure accuracy. 3. Fill in the blanks: Enter the relevant information in the designated fields, ensuring that all terms and conditions are clearly stated. 4. Review and revise: Carefully review the completed agreement to check for any errors or missing details. Make revisions as necessary. 5. Sign and share: Once satisfied with the content, both the lender and borrower should sign the agreement. Make copies for each party and share as needed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.