Profit And Loss Template For Self Employed

What is profit and loss template for self employed?

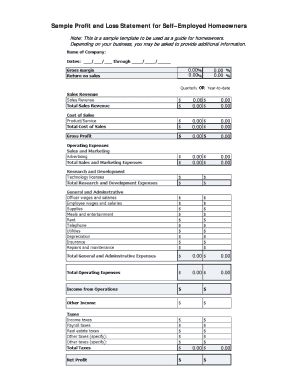

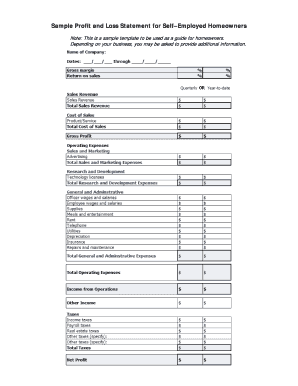

A profit and loss template for self-employed individuals is a financial document that summarizes the revenue, expenses, and net income for a specific period. It helps self-employed individuals track their business performance and evaluate their profitability.

What are the types of profit and loss template for self employed?

There are various types of profit and loss templates available for self-employed individuals. Some common types include:

Simple profit and loss template: This basic template allows you to input your income and expenses to calculate your net profit.

Monthly profit and loss template: This template is designed to track your monthly income and expenses, providing a comprehensive overview of your financial performance.

Yearly profit and loss template: This template summarizes your annual income, expenses, and net profit, giving you a broader perspective on your business's financial health.

How to complete profit and loss template for self employed

Completing a profit and loss template for self-employed individuals is relatively simple. Here are the steps you can follow:

01

Gather all your income sources: Collect information about your revenue from different sources, such as sales, services, or investments.

02

Compile your expenses: Make a list of all your business expenses, including rent, utilities, marketing costs, and supplies.

03

Calculate your net profit: Subtract your total expenses from your total income to calculate your net profit.

04

Review and analyze: Analyze your profit and loss statement to understand your business's financial performance and identify areas for improvement.

05

Update regularly: Update your profit and loss statement regularly to track your progress and make informed business decisions.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out profit and loss template for self employed

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Does Google have a profit & Loss statement template?

Does Google Sheets Have a Profit and Loss Template? As of now, there isn't a Google Sheets P&L template in the template library for you to use. However, it is extremely easy to create on sheets. Add the revenue, gains, losses, expenses, and net income into the monthly profit and loss template.

Can I create my own P&L statement?

First, you can pull together your own statement and create the document using a spreadsheet. Tools like Excel and Google Sheets have templates. We've created a simple profit and loss statement template for you to use here. Or, you can use small business accounting software like Freshbooks.

How do I make a P&L spreadsheet?

How to Create a Profit and Loss Statement in Excel Download, Open, and Save the Excel Template. Input Your Company and Statement Dates. Calculate Gross Profit. Input Sales Revenue to Calculate Gross Revenue. Input the Cost of Goods Sold (COGS) Calculate the Net Income. Input Your Business Expenses.

How do I create a profit and loss statement for self employed?

How to write a profit and loss statement Step 1: Calculate revenue. Step 2: Calculate cost of goods sold. Step 3: Subtract cost of goods sold from revenue to determine gross profit. Step 4: Calculate operating expenses. Step 5: Subtract operating expenses from gross profit to obtain operating profit.

Who needs a profit and loss statement?

A profit and loss (P&L) is an indicator of company health. The P&L is one of the primary documents you'll need to provide to acquire financing. It allows banks and investors to see your business's total income, debt load and financial stability. Anyone can create a P&L statement with some training and practice.

Is statement of profit and Loss mandatory?

By Schedule III of the Companies Act, 2013, companies must prepare a profit and loss statement.

Related templates