What is simple personal budget template?

A simple personal budget template is a tool that helps individuals track their income and expenses in order to better manage their finances. It allows users to input their sources of income and record their expenses, making it easier to analyze where their money is going and identify areas for potential savings. By utilizing a simple personal budget template, users can gain greater control over their financial health and make informed decisions about their spending habits.

What are the types of simple personal budget template?

There are various types of simple personal budget templates available to suit different needs and preferences. Some common types include:

Basic budget template: This type of template provides a simple framework for tracking income and expenses without any additional features.

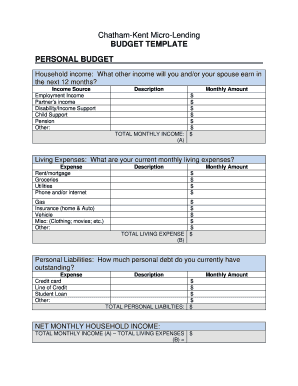

Monthly budget template: This template allows users to plan their finances on a monthly basis, helping them allocate their income and set spending limits accordingly.

Annual budget template: Ideal for long-term financial planning, this template enables users to project their income and expenses for the entire year.

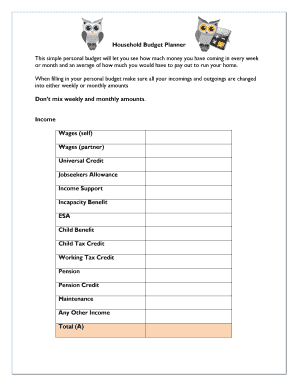

Household budget template: Designed for managing household finances, this template helps track shared expenses, such as rent, utilities, and groceries.

Expense tracking template: This template focuses solely on recording and categorizing expenses, making it easier to analyze spending patterns and identify areas for improvement.

How to complete simple personal budget template

Completing a simple personal budget template is a straightforward process that involves the following steps:

01

Gather your financial information: Collect all relevant financial documents, such as bank statements, pay stubs, and bills. This will provide an accurate picture of your income and expenses.

02

Identify your income sources: List down all sources of income, including salary, investments, and any additional earnings.

03

Track your expenses: Record all your expenses, categorizing them into different groups such as housing, transportation, food, and entertainment.

04

Calculate your savings: Deduct your total expenses from your income to determine your savings for the period.

05

Analyze your budget: Assess your spending habits and identify areas where you can cut back, save money, or adjust your budget.

06

Make adjustments as needed: As your financial situation evolves, update your budget template to reflect any changes in income or expenses.

07

Regularly review and track your progress: Continuously monitor your budget and compare your actual expenses to your budgeted amounts to ensure you are staying on track.

08

Utilize digital tools: Consider using online platforms like pdfFiller to create, edit, and share your budget template conveniently.

With pdfFiller, you can conveniently create, edit, and share your simple personal budget template online. pdfFiller offers unlimited fillable templates and powerful editing tools, making it the only PDF editor you need to efficiently manage your financial documents.