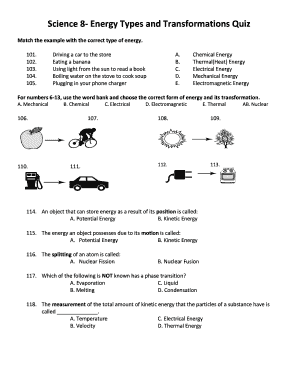

Types Of Promissory Notes

What is types of promissory notes?

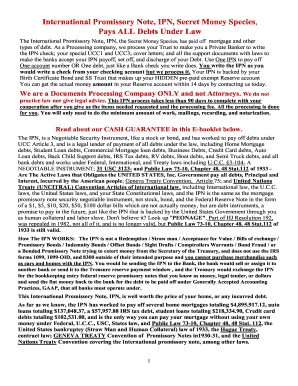

A promissory note is a legal financial instrument that contains a written promise by one party to pay a specific sum of money to another party at a future date or upon demand. Promissory notes are commonly used in various financial transactions, such as loans, mortgages, and business agreements. There are several types of promissory notes, each serving different purposes and having different terms and conditions.

What are the types of types of promissory notes?

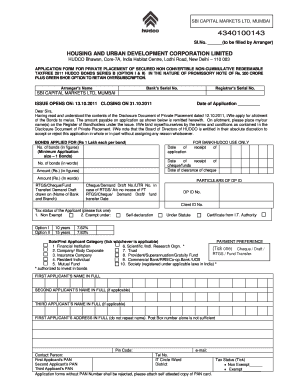

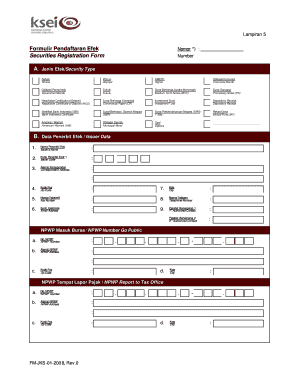

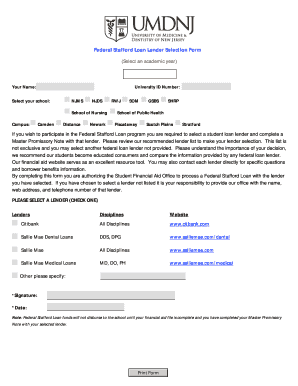

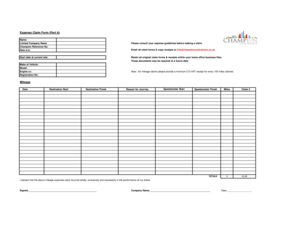

The types of promissory notes vary depending on the purpose and terms of the agreement. Here are some common types of promissory notes: 1. Demand Promissory Note: This type of promissory note requires the borrower to repay the loan upon demand by the lender. 2. Installment Promissory Note: This type of promissory note allows the borrower to repay the loan in regular installments over a specified period of time. 3. Secured Promissory Note: This type of promissory note is backed by collateral, such as a property or asset, which the lender can claim if the borrower fails to repay the loan. 4. Unsecured Promissory Note: This type of promissory note is not backed by any collateral, making it riskier for the lender. 5. Convertible Promissory Note: This type of promissory note gives the lender the option to convert the loan into equity in the borrower's company. 6. Revolving Promissory Note: This type of promissory note allows the borrower to borrow and repay funds multiple times within a specified credit limit.

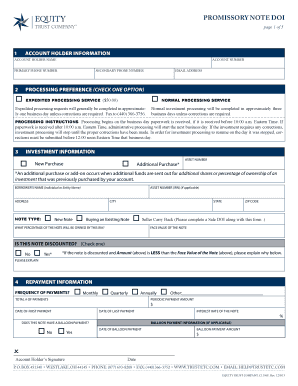

How to complete types of promissory notes

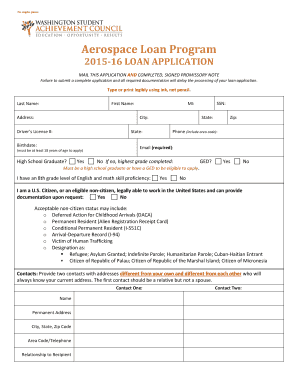

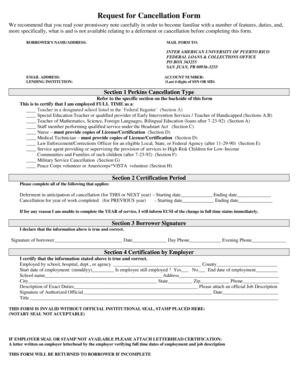

Completing a promissory note requires careful attention to detail and adherence to legal requirements. Here are the steps to complete a promissory note: 1. Identify the parties involved: Include the names and contact information of the borrower and lender. 2. Specify the loan amount: Clearly state the principal amount borrowed. 3. Define the interest rate: State the interest rate charged on the loan, if applicable. 4. Determine the repayment terms: Specify the repayment schedule, including any installment amounts and due dates. 5. Include any additional terms: If there are any specific terms or conditions related to the loan, such as late payment penalties or grace periods, include them in the note. 6. Sign and date the promissory note: Both the borrower and lender should sign and date the document to make it legally binding.

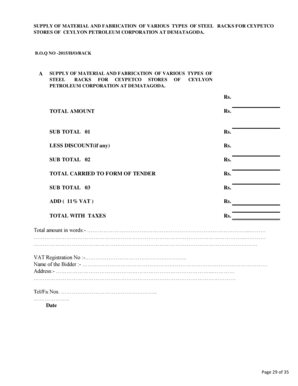

pdfFiller is an online platform that empowers users to easily create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done efficiently and professionally.