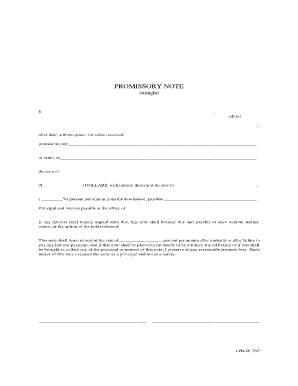

Simple Promissory Note Sample

What is simple promissory note sample?

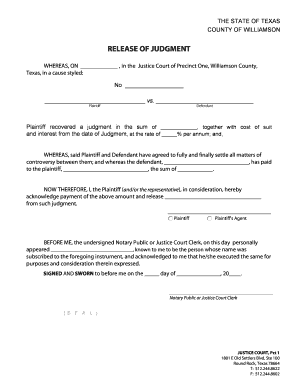

A simple promissory note sample is a legal document that outlines a borrower's promise to repay a loan to a lender within a specified timeframe. It serves as evidence of the borrower's intention to repay the debt and includes important details such as the loan amount, interest rate, and repayment terms.

What are the types of simple promissory note sample?

There are several types of simple promissory note samples available, depending on the specific needs and circumstances of the loan transaction. These may include: 1. Unsecured Promissory Note: This type of promissory note does not require any collateral and is solely based on the borrower's promise to repay the loan. 2. Secured Promissory Note: In contrast to an unsecured note, a secured promissory note includes collateral, such as real estate or a vehicle, that the lender can claim in case of default. 3. Demand Promissory Note: This type of note allows the lender to demand repayment of the loan amount at any time, without specifying a fixed term. 4. Installment Promissory Note: An installment note divides the loan amount into a series of fixed payments over a predetermined period. 5. Balloon Promissory Note: This note requires smaller periodic payments at the beginning of the repayment term and a larger final payment, known as a balloon payment, at the end.

How to complete simple promissory note sample

Completing a simple promissory note sample involves the following steps: 1. Identify the parties involved: Include the names and contact information of both the borrower and the lender. 2. Define the loan amount: Specify the exact amount of money borrowed. 3. Set the interest rate: Determine the interest rate applicable to the loan, if any. 4. Establish the repayment terms: Outline the schedule and method of repayment, including any installment amounts or balloon payment due dates. 5. Include any additional terms: Add any special conditions or requirements specific to the loan, such as late payment penalties or early repayment options. 6. Sign and date the document: Both parties should sign and date the completed promissory note to make it legally binding. It's advisable to have a witness present, if possible.

pdfFiller is an online platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to efficiently handle your documents and ensure their completion.