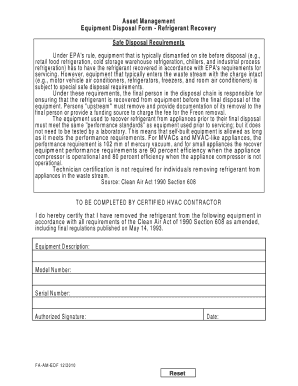

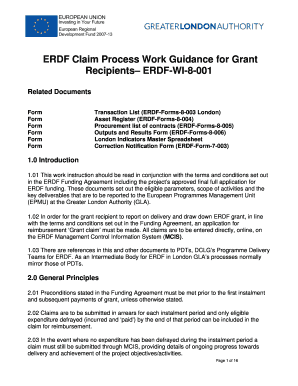

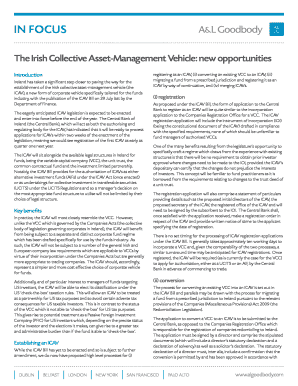

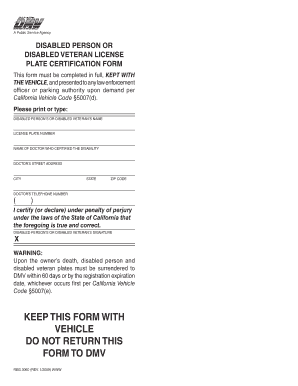

What is Asset Register Form?

An Asset Register Form is a document used to record and track the assets owned by an individual, company, or organization. It serves as a centralized record of all the assets, including their details such as purchase date, value, depreciation, and any other relevant information. The Asset Register Form helps in properly managing and accounting for the assets owned.

What are the types of Asset Register Form?

There are several types of Asset Register Forms, each designed to cater to specific needs and industries. The common types of Asset Register Forms include:

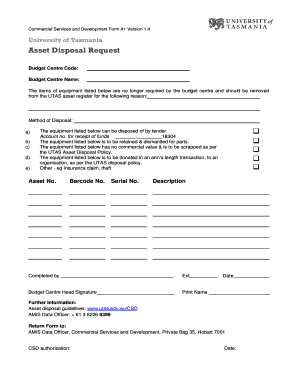

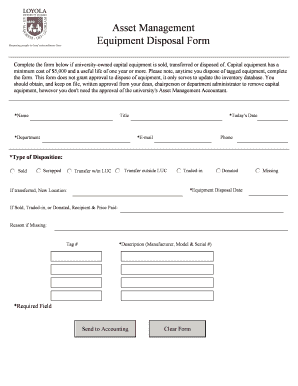

Fixed Asset Register Form: Used to track long-term assets such as buildings, machinery, vehicles, and equipment.

IT Asset Register Form: Specifically used to manage and track IT assets like computers, servers, software licenses, and network devices.

Inventory Asset Register Form: Focuses on tracking inventory assets, including raw materials, finished goods, and consumables.

Financial Asset Register Form: Used to keep a record of financial assets such as stocks, bonds, and other investments.

Personal Asset Register Form: Helps individuals in managing their personal assets, such as real estate, vehicles, jewelry, and valuable possessions.

How to complete Asset Register Form

Completing an Asset Register Form may vary depending on the specific form used. However, the general steps include:

01

Start by gathering all the necessary information about the asset, such as its description, purchase date, cost, and other relevant details.

02

Fill in the required fields of the Asset Register Form with the gathered information. Make sure to enter accurate and up-to-date data.

03

Attach any supporting documents or evidence related to the asset, such as receipts, invoices, or warranty information.

04

Review the completed form for any errors or missing information. Double-check all the entered data to ensure its accuracy.

05

Save or submit the Asset Register Form as per the instructions provided, either in physical or digital format.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.