Authorisation Letter For Bank

What is authorisation letter for bank?

An authorisation letter for bank is a document that grants someone else the authority to act on your behalf in banking matters. It gives them the power to carry out transactions, such as depositing or withdrawing money, signing cheques, or accessing your account information. This letter is commonly used when you are unable to be physically present at the bank or when you want to delegate certain banking tasks to someone else.

What are the types of authorisation letter for bank?

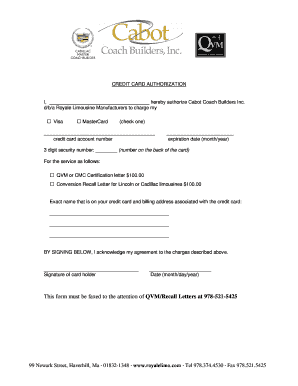

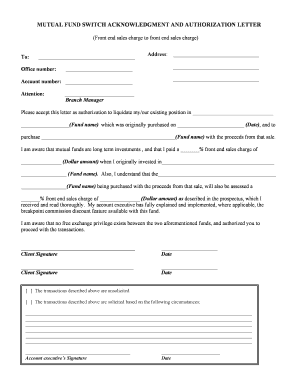

There are several types of authorization letters for bank that serve different purposes. The most common types include: 1. Account Access Authorization: This letter grants someone access to your bank account but does not give them the authority to make transactions. 2. Financial Transaction Authorization: This letter allows someone to carry out financial transactions on your behalf, such as depositing or withdrawing money. 3. Power of Attorney Authorization: This is a more comprehensive authorization that grants someone the power to act on your behalf in various legal and financial matters, including banking. 4. Specialized Authorization: Some banks may have specific authorization forms for certain actions, such as closing an account or requesting a loan.

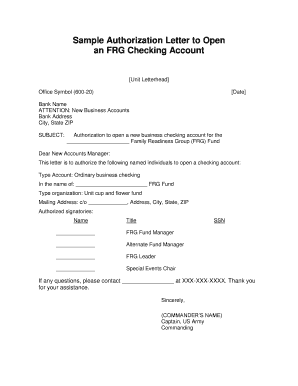

How to complete authorisation letter for bank

Completing an authorization letter for the bank is a straightforward process. Here are the steps to follow: 1. Start by addressing the letter to the specific bank or branch manager. 2. Include your full name, address, and contact information. 3. Clearly state the purpose of the letter and the tasks you are authorizing the recipient to perform. 4. Specify the duration of the authorization, if applicable. 5. Include any supporting documents or identification proof, if required. 6. Sign the letter and consider getting it notarized for added validity. 7. Keep a copy of the letter for your records and provide a copy to the authorized person.

pdfFiller is an innovative online platform that empowers users to create, edit, and share documents securely and conveniently. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor to streamline your document management. Whether you need to create an authorization letter for the bank or any other document, pdfFiller has got you covered.