What is Budget Planner?

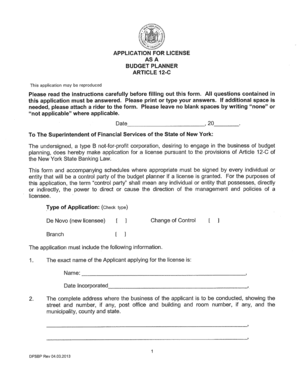

A Budget Planner is a tool that allows individuals or businesses to track their income and expenses, create a budget, and manage their finances effectively. It helps users gain a clearer understanding of their financial situation, make informed decisions, and achieve their financial goals.

What are the types of Budget Planner?

There are various types of Budget Planners available to cater to different needs and preferences. Some common types include:

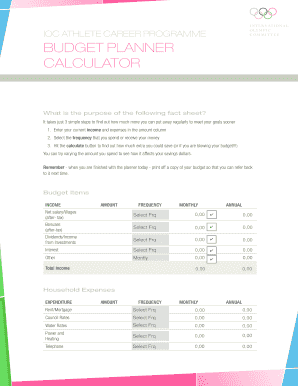

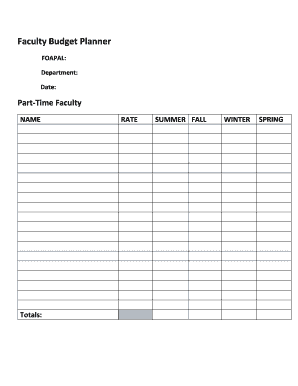

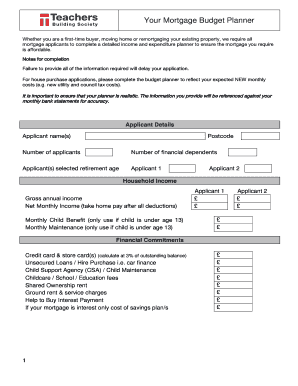

Spreadsheet-based Budget Planners: These are electronic spreadsheets that allow users to input their income and expenses, calculate totals, and visualize their budget using graphs and charts.

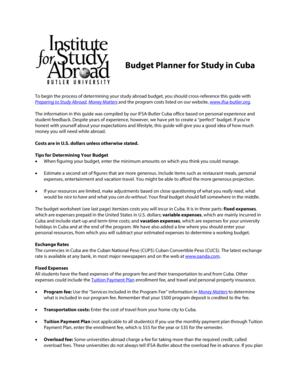

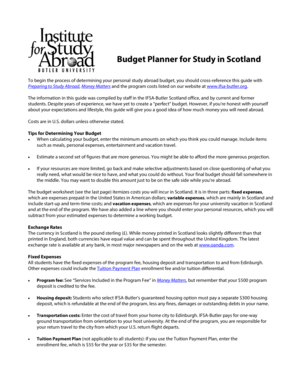

Online Budget Planners: These are web-based applications or mobile apps that enable users to create and manage their budget online. They usually offer additional features such as automatic categorization of expenses, goal tracking, and synchronization across devices.

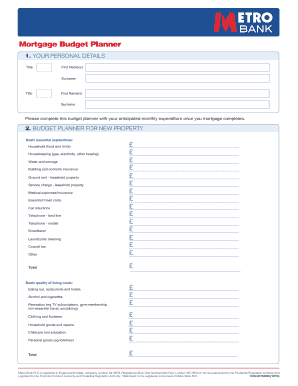

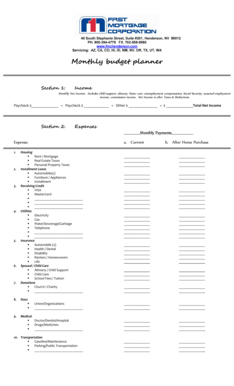

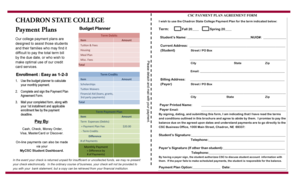

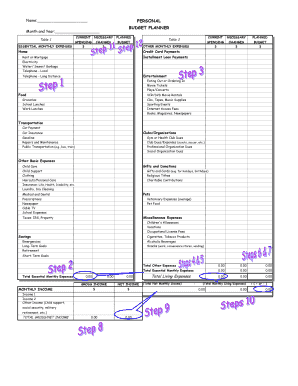

Printable Budget Planners: These are printable templates that users can download, print, and fill out manually. They are useful for individuals who prefer a physical copy of their budget or who do not have access to electronic devices.

Budgeting Software: These are dedicated software programs that provide advanced budgeting features, such as expense tracking, bill management, and financial forecasting. They often require a purchase or subscription.

Budgeting Apps: These are smartphone applications that offer budgeting tools and features. They are convenient for users who prefer managing their budget on-the-go and want quick access to their financial information.

How to complete Budget Planner

Completing a Budget Planner is a straightforward process that requires attention to detail and regular updates. Here are the steps to complete your Budget Planner:

01

Gather your financial information: Collect all your income sources, such as salary, freelance work, or investment returns. Also, gather information about your regular expenses, including bills, groceries, and transportation costs.

02

List all your income and expenses: Write down all your income sources and categorize them. Then, list your expenses and categorize them as well. Be as specific as possible to get an accurate overview of your finances.

03

Calculate your totals: Add up all your income and expenses to calculate your total income and total expenses. Subtract your total expenses from your total income to determine your surplus or deficit.

04

Analyze your budget: Examine your budget to identify areas where you can make adjustments or cut costs. Look for opportunities to save or reallocate funds to reach your financial goals.

05

Make adjustments: Based on your analysis, make adjustments to your budget by reducing expenses, increasing income, or reprioritizing your financial goals. By doing so, you can achieve a balanced budget and improve your financial well-being.

06

Track and update regularly: Regularly update your Budget Planner to reflect any changes in your income or expenses. Track your progress, monitor your budget closely, and make necessary adjustments throughout the month to stay on track with your financial goals.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.