What is Employee Loan Agreement?

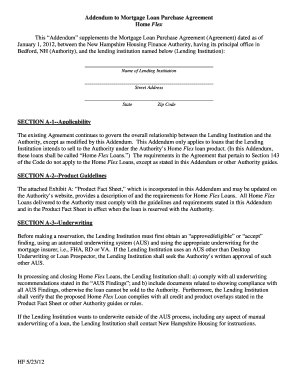

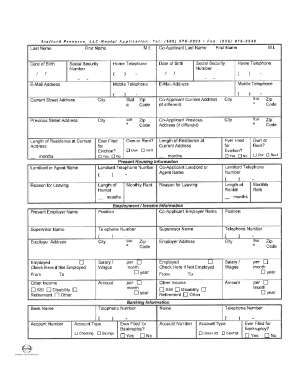

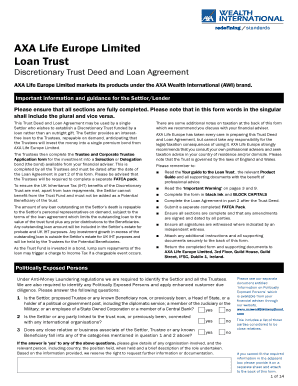

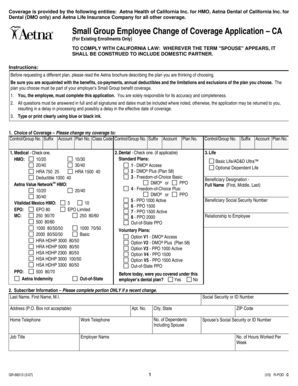

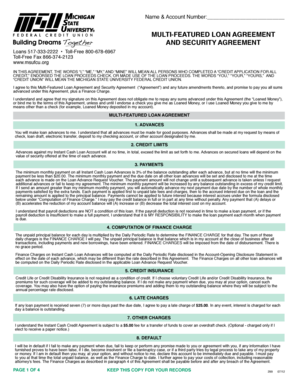

Employee Loan Agreement is a legal document that outlines the terms and conditions of a loan between an employer and an employee. It specifies the amount of the loan, the interest rate, and repayment terms. This agreement is designed to protect both parties and ensure that the loan is repaid in a timely manner.

What are the types of Employee Loan Agreement?

There are several types of Employee Loan Agreements that can be used depending on the specific circumstances. These include:

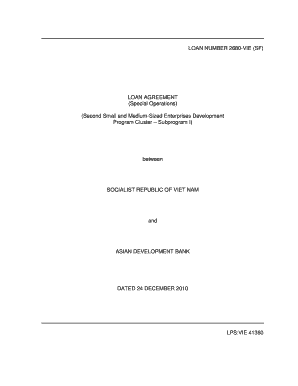

Secured Employee Loan Agreement: This type of agreement requires the employee to provide collateral to secure the loan. The collateral could be a valuable asset such as a property or a vehicle.

Unsecured Employee Loan Agreement: Unlike a secured loan, an unsecured loan does not require collateral. Instead, the agreement relies solely on the borrower's creditworthiness and ability to repay the loan.

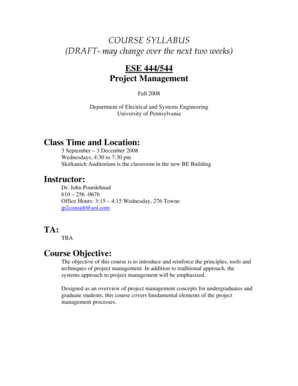

Promissory Note: A promissory note is a simpler form of a loan agreement that outlines the basic terms of the loan, including the amount borrowed, the interest rate, and the repayment schedule. It is usually used for smaller loans or informal agreements between employers and employees.

How to complete Employee Loan Agreement

Completing an Employee Loan Agreement is a straightforward process. Here are the steps you need to follow:

01

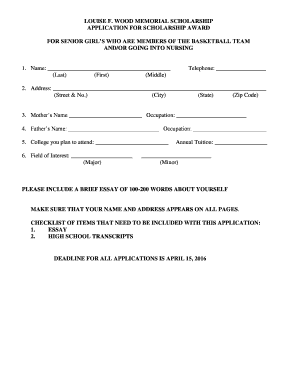

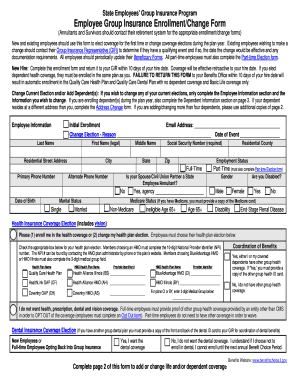

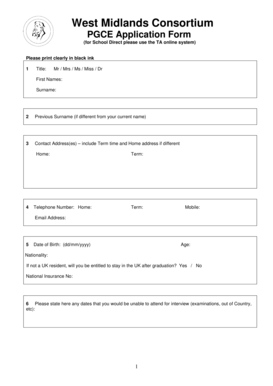

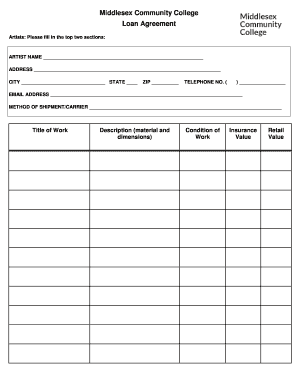

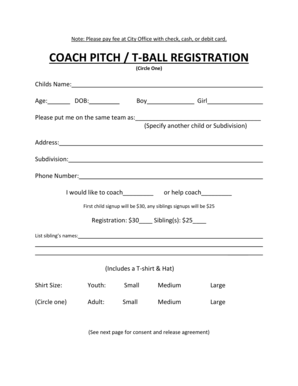

Begin by downloading a template of an Employee Loan Agreement or use an online platform like pdfFiller to create a customized agreement.

02

Fill in the required information, including the names of the borrower and the lender, the loan amount, the interest rate, and the repayment terms.

03

Review the agreement carefully to ensure that all the terms are accurate and satisfactory for both parties.

04

Sign and date the agreement, and have the borrower and the lender sign as well.

05

Make copies of the signed agreement for both parties to keep for their records.

06

Store the completed agreement in a secure location for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.