Employee Advance Agreement

What is an employee advance agreement?

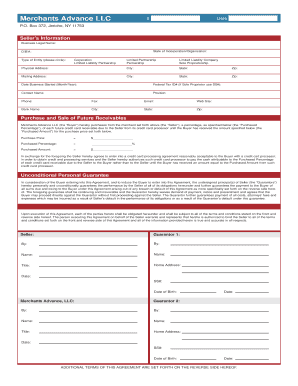

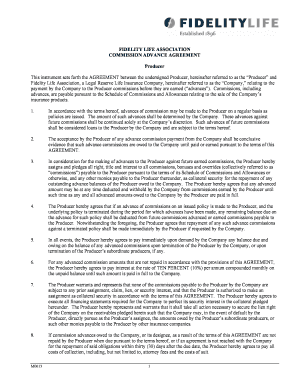

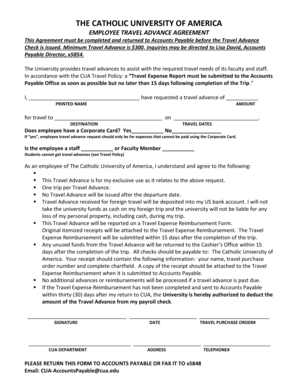

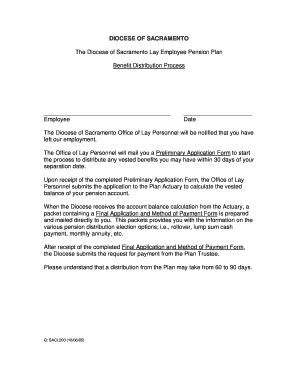

An employee advance agreement is a legal document that outlines the terms and conditions of providing an advance payment to an employee. It establishes the agreement between the employer and the employee regarding the repayment of the advance amount.

What are the types of employee advance agreement?

There are two common types of employee advance agreements:

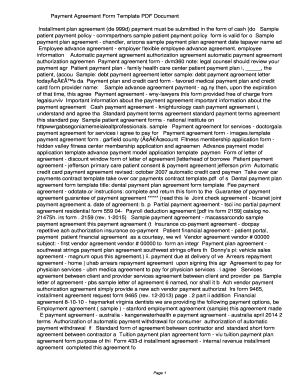

Salary advance agreement: This type of agreement allows the employee to request an advance on their salary. The advance amount is deducted from future paychecks until fully repaid.

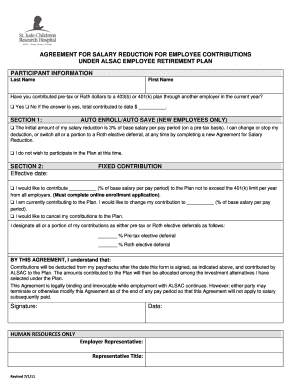

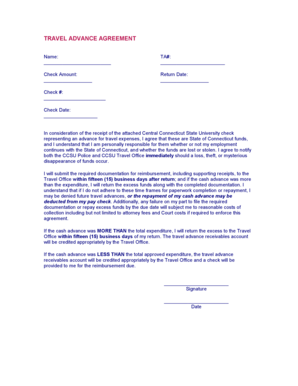

Expense advance agreement: This agreement allows employees to request an advance for business-related expenses. The employee is required to provide an expense report and the advance amount is typically deducted from future reimbursements.

How to complete an employee advance agreement?

Follow these steps to complete an employee advance agreement:

01

Identify the parties involved: Include the names and positions of both the employer and the employee.

02

Specify the advance amount: Clearly state the amount that will be provided to the employee as an advance.

03

Set the repayment terms: Define the method and schedule of repayment, including any interest or fees that may apply.

04

Outline any conditions or restrictions: State any specific conditions or restrictions related to the advance, such as its purpose or limitations on use.

05

Obtain signatures: Ensure that both the employer and the employee sign the agreement to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out employee advance agreement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is it OK to ask for an advance at work?

If you're in a financial emergency, you can ask your employer for a salary advance, which pays an upfront sum that's deducted from future wages. If they say yes, it can save you from predatory lending options. But it still has potential risks to be aware of, such as reduced future paychecks.

What to do if an employee asks for an advance?

When an employee asks you for an advance, do not pry into their situation. You probably want to be sure the money will be used for what you deem as a good reason, but resist. Inform the employee of your salary advance policy. Make sure they understand the terms.

Can employers give cash advances?

A paycheck advance is an advance on your future paycheck that you can get through your employer. With this type of short-term loan, your employer advances you money and deducts repayments from future paychecks. With most services, employees qualify for the same rates and terms — regardless of your credit score.

How does an employee advance work?

A payroll advance is a financial agreement between an employer and an employee. The employee receives money from the employer in the form of a short-term loan. The loan is paid back to the employer using future earned wages.

How do I write a letter of salary advance?

I am writing this letter to request you to grant me two months' salary in advance for my personal needs. It would be helpful if I could receive two months salary (Rs. 40,000/-) in advance, on or before 12th March, 2022. The money can be deducted in instalments from my salary in the coming months.

How do I give an employee a pay advance?

Simply add the money type to the employee's pay and set the total amount of the advance. If you choose to pay the advance outside of a regular payroll run, be sure to skip any voluntary deductions on the advance payout. After paying the advance, you need to create a deduction for future payroll runs.

Related templates