Escrow Agreement Real Estate

What is escrow agreement real estate?

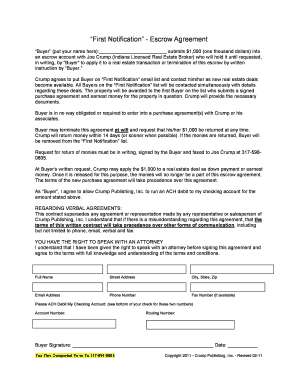

An escrow agreement in real estate refers to a legally binding arrangement where a neutral third party holds funds and important documents during a transaction between a buyer and a seller. This ensures that both parties comply with the agreed-upon terms and conditions before the completion of the transaction. The escrow agent acts as a trusted intermediary and helps facilitate a smooth and secure real estate transaction.

What are the types of escrow agreement real estate?

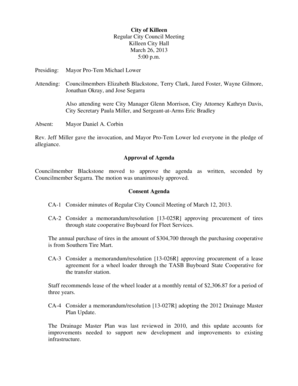

There are several types of escrow agreements in real estate based on the specific situation and purpose. Some common types include: 1. Purchase and Sale Escrow: This type of escrow agreement is used when a buyer and a seller enter into a contract for the sale of a property. The escrow agent holds the buyer's earnest money deposit until all conditions of the contract are met. 2. Construction Escrow: In construction projects, an escrow agreement can be used to hold funds in trust. The funds are released to the contractor based on the completion of agreed-upon milestones or stages of the project. 3. Lease Escrow: This type of escrow agreement is used when a tenant is required to make a security deposit before leasing a property. The escrow agent holds the deposit and returns it to the tenant at the end of the lease term, subject to any applicable deductions. 4. Mortgage Escrow: A mortgage escrow agreement is entered into between a borrower and a lender. The escrow agent holds funds for property taxes, insurance, and other expenses related to the mortgage, ensuring they are paid on time.

How to complete escrow agreement real estate

Completing an escrow agreement in real estate involves several steps to ensure a successful transaction. Here's a step-by-step guide: 1. Identify an Escrow Agent: Choose a reliable and experienced escrow agent who will act as a neutral third party throughout the transaction. 2. Draft the Agreement: Work with your real estate attorney or use a trusted online platform like pdfFiller to create a legally binding escrow agreement. Specify the terms, conditions, and responsibilities of all parties involved. 3. Review and Sign: Carefully review the agreement and seek legal advice if necessary. Once satisfied, all parties should sign the agreement. 4. Deposit Funds and Documents: The buyer should deposit the agreed-upon funds into the escrow account. The seller should provide any required documents, such as the title deed or property disclosures. 5. Fulfill Conditions: Both parties must fulfill the conditions mentioned in the escrow agreement, such as property inspections, mortgage approvals, or repairs. 6. Close the Escrow: Once all conditions are met, the escrow agent will disburse the funds to the seller, transfer the title, and close the escrow. Any remaining funds will be returned to the buyer. Remember, using a trusted platform like pdfFiller can streamline the completion of an escrow agreement by providing fillable templates and powerful editing tools.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.